Issue 1 | AOFM Investor Insights | May 2019 | PDF

Most issuance occurs via competitive price tenders. The AOFM determines the maturity and volume issued while bidders determine yields. The AOFM usually tenders weekly for Treasury Bonds and twice a month for Treasury Indexed Bonds and Treasury Notes. In recent years, around 80 per cent of the AOFM’s annual funding task has been achieved via tenders.

Syndications provide greater flexibility in managing execution risk but can be a more expensive issuance method. They have mostly been used to establish new bond lines but on some occasions to tap existing long-dated[1] bond lines.

Table 1: Key contrasting features between tenders and syndications

| Tenders | Syndications |

|---|---|

|

|

Benefits to the AOFM and the market of the respective issuance methods

The choice of issuance method takes into account the benefits, costs and potential risks of each method. Syndications are usually considered when:

- Funding risk is high (a large annual issuance task).

- Execution risk is high due to:

- uncertain demand

- pricing uncertainty (in the case of yield curve extensions)

- market congestion (price makers are holding more bonds than they can sell)

- heightened market volatility.

Below are some of the benefits we perceive to the AOFM and the market.

Tenders

Benefits to the AOFM

Are an efficient and cost-effective way to raise funds

- Results in a competitive, market-determined price.

- Direct issuance costs to the AOFM are minimised.

- Allows issuance into market demand.

- Simple, well understood process and transparent.

Provides regular market intelligence to the AOFM

- Tender performance provides an indicator of market conditions (through the appetite and bidding behaviour of bidders).

- Takedown of bonds in tenders is a factor for bank inclusion on syndication panels.

Benefits to the market

Provides a regular supply of AGS and adds liquidity to the market

- Transparent and predictable issuance.

- Provides issuance flexibility during heightened market volatility.

- Act as market liquidity events (including indirectly for other bonds on the curve).

- Allows market makers confidence to short frequently tendered bonds.

- Pricing reflects bidder assessments of market conditions and relative strength of intermediaries.

- Market demand updated to AOFM each week.

Syndications

Benefits to the AOFM

- Allows high volume issuance in a single transaction with confidence around price.

- AOFM exercises market appropriate discretion over pricing, volume, and allocations. Volume builds early liquidity and is used to encourage post syndication performance.

- Reduces the risks attached to establishing a new bond for which there is no secondary market (for example, a curve extension).

- A ‘window’ to direct investor participation in AGS (enhancing the AOFM's understanding of the AGS market).

- Fees motivate banks to trade and promote AGS.

- Bonds go directly to investors which could overcome congestion risk when market conditions are strained.

Benefits to the market

- Investors receive an allocation at a single known price or spread to a price reference (unlike tenders).

- Investors can pursue a substantial allocation to a new issue (often with a new issuance concession).

Further considerations

The decision to use syndication is often more nuanced than it may appear and the AOFM’s specific objectives when choosing between tender and syndication will vary according to market conditions, the overall size of the annual issuance task, where on the yield curve the transaction will take place, and the ability to build a new line quickly for liquidity purposes.

Size of the funding task

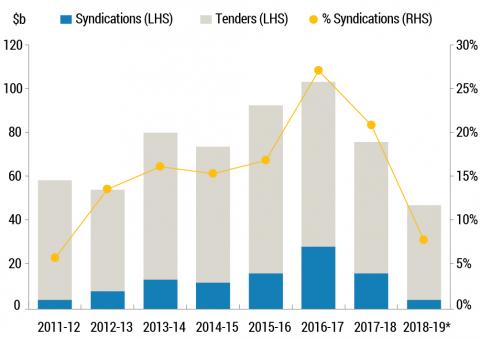

Chart 1 shows the relationship between the AOFM’s use of syndications and the overall size of the program. The highest proportion of syndicated issuance occurred in 2016-17 against a gross issuance program of $103 billion. The next two largest issuance years also had high proportions of syndicated issuance.

Chart 1: Treasury Bond tenders and syndications since 2011-12

Treasury Bond or Treasury Indexed Bond

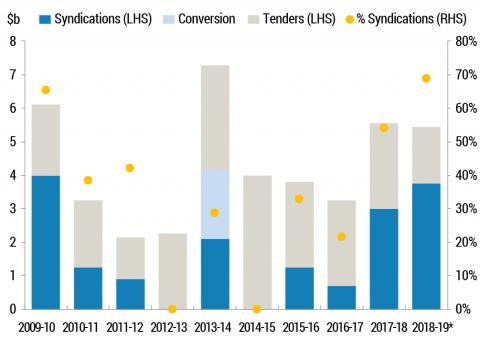

The AOFM uses syndications for both. The differences between the Treasury Bond (TB) and Treasury Indexed Bond (TIB) markets are important when considering syndications. The latter is considerably smaller, has less depth and liquidity and a more concentrated investor base.

New TIB lines are typically launched via syndication with overall issuance by this method comprising a higher proportion than for TBs. Since 2009, all new TIB maturities bar one (November 2018) have been initially issued by syndication.

Chart 2: Treasury Indexed Bond tenders and syndications since 2009-10

Syndication is an important tool for building lines where liquidity tends to be structurally lower (ultra-long bonds). The lower liquidity in these bonds is generally a reflection of a narrower range of investor interest together with a greater tendency of investors to ‘buy and hold’. Holding these bonds also requires intermediaries to carry more risk. Therefore, tenders in ultra-long bonds are held less frequently and usually for a much lower volume. The balance between the use of tenders and small syndications in this part of the yield curve therefore remains a more active consideration by the AOFM.

Lengthening the yield curve and long issuance bias

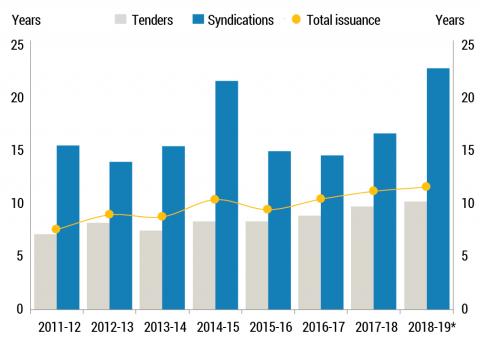

Since 2011, the AOFM has incrementally lengthened the yield curve from 12 to 30 years. Chart 3 highlights the extent to which syndications have been relied on to issue long-dated maturities.

Chart 3: Volume weighted tenor of issuance

All curve extensions have been launched via syndication because this reduced execution risk in a curve segment where investor demand was untested and facilitated earlier trading liquidity in new bond lines.

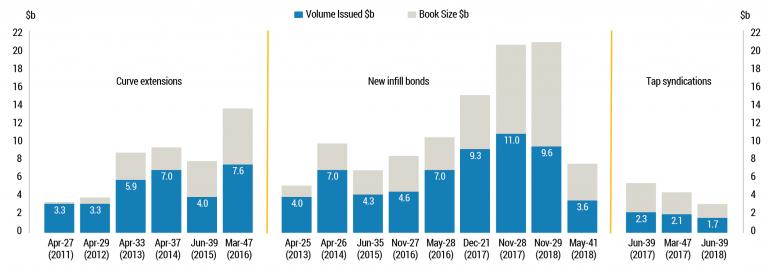

Chart 4 shows book and print size for nominal bond syndications since 2011. Over time syndications have become an effective and efficient issuance method, although the AOFM has remained mindful of the negative market impact from ‘pushing too hard’ on print volumes. The AOFM considers the type of maturity a syndication will have, whether it is a curve extension, infill bond or tap syndication. In each instance there is a judgement to be made about balancing investor appetite for new bond issuance, accelerating the annual issuance program while the opportunity presents, and performance of a new bond line ahead of it being tapped after syndication.

Chart 4: Treasury Bond syndications, volume issued and book size

Looking forward

While syndications have been a highly effective and efficient method for establishing new bond lines, achieving yield curve extensions and facilitating liquidity in ultra-long bond lines, competitive tenders will remain the focal point of the AOFM’s issuance operations. Market conditions and the size of annual issuance tasks will be the most important factors underlying future consideration by the AOFM of using syndications. Regular issuance by tender remains the best way for AOFM to support the market while meeting its commitment to achieve cost effective financing for Government on behalf of taxpayers over time. However, operational decisions require informed judgement in circumstances for which syndications will be useful to AOFM and the market and this will remain an active part of issuance planning.

[1] ‘Long-dated’ refers to bonds comprising the 10-year futures contract and longer; ‘ultra-long’ refers to bonds comprising the 20-year futures contract and longer.