Issue 10 | AOFM Investor Insights | August 2022 | PDF

Introduction

The AOFM recently conducted 24 investor meetings in Tokyo; the first visit to Japan since before the onset of the COVID-19 pandemic. Investors were highly engaged and in many instances had prepared detailed questions. Meetings were held with a diverse group of investors, which included pension funds, life insurers, general insurers, fund managers, bank balance sheets, and official institutions.

Table 1. Number of investor meetings

| Investor Category | |

|---|---|

| Life Insurer | 7 |

| Domestic Fund Manager | 5 |

| Public Sector Bank | 3 |

| International Fund Manager | 3 |

| Mega Bank | 2 |

| Official Institution | 2 |

| General Insurer | 1 |

| Regional Bank | 1 |

Tokyo has the highest concentration of individual investor names holding Australian Government Securities (AGS). For many years Japanese investors have looked offshore for higher returns and this has regularly included AGS.

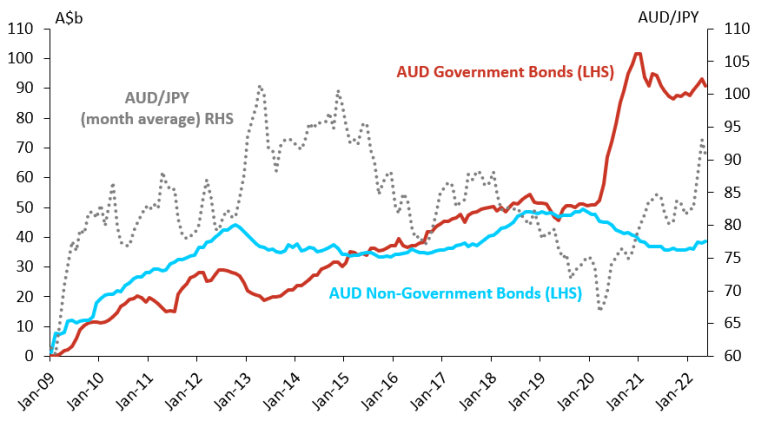

Chart 1 shows consistent inflows into Australian fixed income by Japanese investors since the GFC. Calendar 2020 was a notably strong year for Japanese inflows into AUD government bonds (sovereign and semis); this was facilitated by a material increase in supply with both levels of government sharply increasing borrowing programs in response to COVID pandemic fiscal stimulus.

Chart 1. Cumulative net flow by Japanese investors into Australian fixed income

Source: Japan Ministry of Finance

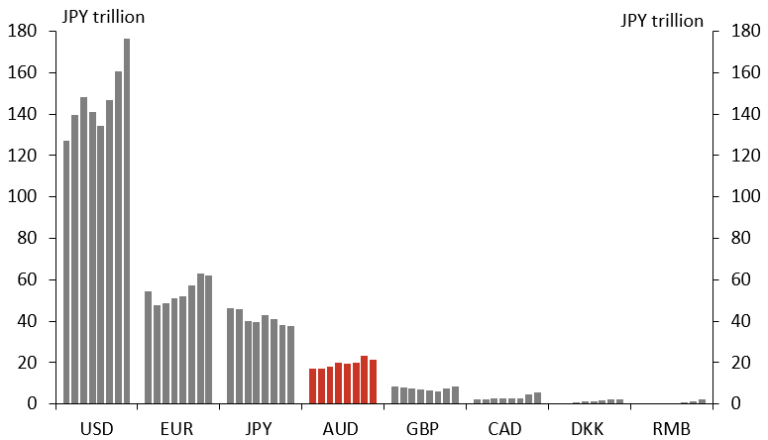

Since the beginning of 2021, there has been some unwinding of AUD holdings. More recently, a weaker Yen, relatively higher currency hedging costs, and compression of AUD and Japanese Government Bond (JGB) yields in long-dated maturities are impacting demand. Nevertheless, as chart 2 indicates, Japanese investors have remained ‘overweight’ in AUD fixed income, with around 7% of total fixed income allocations as of December 2021.

Chart 2. Japanese investor foreign asset holdings by currency: fixed income (2014 to 2021)

Source: Japan Ministry of Finance

Market conditions and interest rate environment

The recent divergence in interest rate regimes between Japan and elsewhere has created a tendency for a Japanese investor home bias at present. The depreciating Yen has triggered profit taking, while at the same time acting as a barrier to new allocations into foreign currencies.

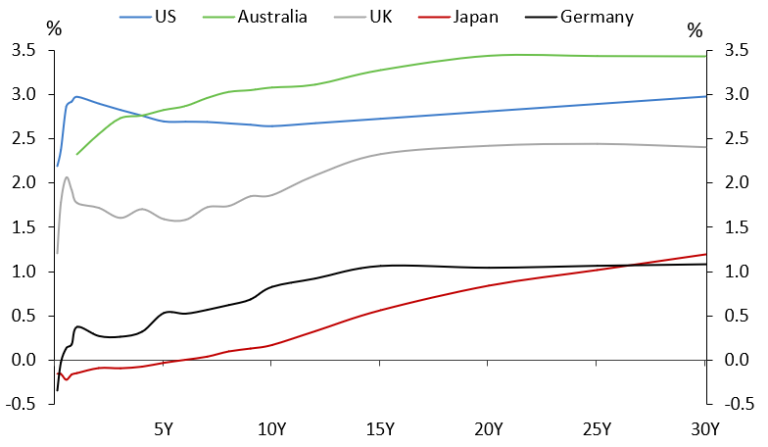

As chart 3 demonstrates, outright AGS yields remain attractive compared to other sovereign markets (i.e. without considering the cost or opportunity of the cross-currency investment component). Interest in AGS is generally (although not in all cases) across the curve. Many investors indicated a willingness to hold bonds out to the longest maturity (the June 2051) to achieve duration targets or increase overall returns. A concentration of interest in bonds comprising the 10-year futures basket was noted though; this of course is consistent with many other parts of the AGS investor base.

Chart 3. Sovereign bond yield curves

Source: Refinitiv, as of 29 July 2022

Many investors indicated they are facing a steep increase in currency hedging costs. For those remaining in AUD positions, quite a few had suggested that this was causing them to engage more heavily in spread products or to take increased duration risk to compensate for higher costs. Quite a few investors revealed they had both hedged and unhedged positions in their portfolios, some indicating slightly higher unhedged positions than normal.

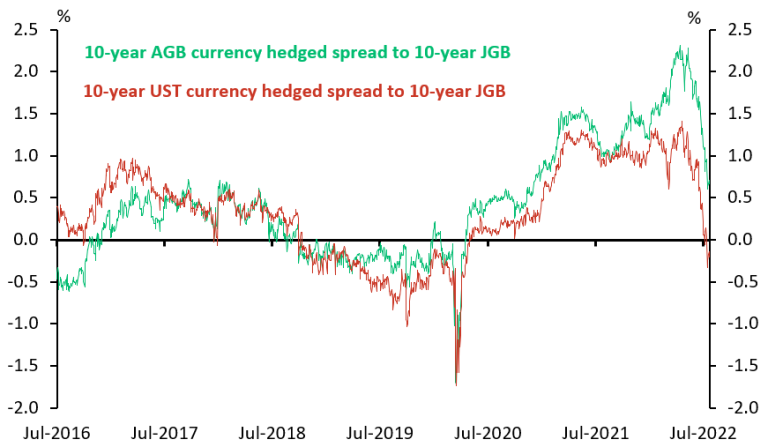

Chart 4 shows the yield spread to a 10-year JGB for a Japanese investor after hedging a 10-year AGS and US Treasury Bond (UST). For AGS the spread using 3-month FX forwards has declined sharply, from over 2% in May to only slightly positive in July; for USTs the spread is already negative. For investors looking to reduce currency risk by hedging AGS with 1-year FX forwards the spread is negative. Should the RBA continue to increase the cash rate and the BoJ policy rate remains fixed (even in relative terms), the 3-month spread could turn negative.

Chart 4. 3-month fx forward currency hedged relative spread to 10-year JGB

Source: Bloomberg, AOFM

Portfolio allocations to AUD products varied from as low as 5% to as high as 20%, and current holdings are consistent with past allocations in terms of including AGS, semi-governments, corporates (mainly the Australian banks), and SSAs. The current weakness in the Yen is weighing heavily on inflows to life insurance products, but an increasing interest from the large Japanese bank balance sheets is a notable change from past visits.

Key themes and questions

The most discussed topics and themes that emerged from investors’ questions were:

- AOFM issuance plans and issuance strategy

- liquidity of the AGS market

- how investors perceive relative value between markets, especially US-AGS spreads

- the outlook for the economy and risks to Budget forecasts

- whether Budget forecasts and issuance volumes may change with the new Government

- RBA and other central bank monetary policy operations

- trends in AGS holdings by other investors

- changes to Australia’s environmental policies and the potential for the AOFM to issue a labelled green bond.

Central Bank operations

Investors were focused on when and at what level the RBA cash rate will reach a peak. The RBA is viewed to be behind many other developed markets in the current rate hiking cycle. At the margin, this seems to be causing some investors to delay new AGS allocations until they have greater confidence about the ‘terminal’ cash rate. Some investors, however, made the point that the relatively steeper AGS curve and higher outright AGS yields provided a buying opportunity if your view is that the cash rate won’t rise as much as market-implied expectations.

Investors also noted some confusion over the RBA’s approach to ‘forward guidance’ and action around its yield targeting operations (especially the abrupt end to the program in 2021).

It was noted that bid/offer spreads in the short end of the yield curve are still wider than before the RBA’s yield target operations but are gradually recovering. Bond lines around the 10-year futures basket remain the most liquid, with the tightest bid/offer spreads.

Australia/US bond spreads and relative value

Many Japanese investors are highly focused on AGS/UST spreads, especially the 10-year spread. Several investors noted that they required a ‘premium’ or positive spread to hold AGS over USTs based on liquidity. Investors were interested in discussing whether widening spreads were impacting investor behaviour generally, and whether the AOFM had a view about the level and direction of the spreads.

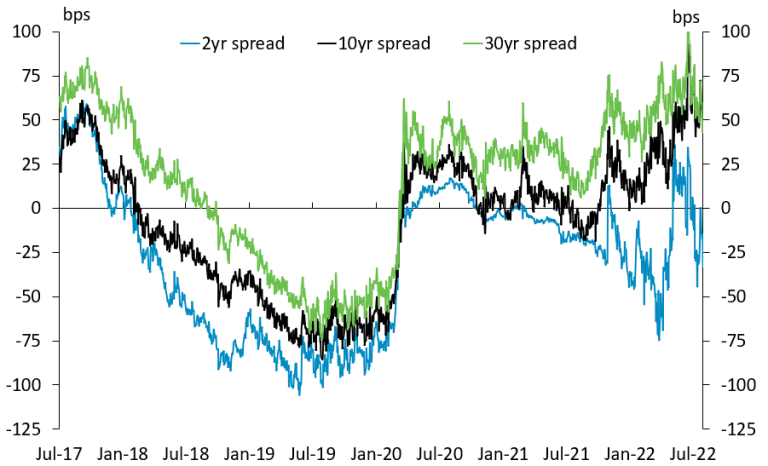

Chart 5. Australia/US Bond spreads

Source: Refinitiv

AOFM messaging

AOFM is a ‘price taker’ and has limited impact on market yields and spreads over time (although we recognise our behaviour at a point in time can influence these). Many factors influence investor demand for AGS, with spreads being only one. That said, we did not notice an appreciable decline in offshore investor holdings when AU/US spreads were negative in 2018-2019; but equally the current widening of spreads has not yet resulted in a strong wave of buying.

The economic outlook and Budget forecasts

Investors were interested in discussing whether a deteriorating economic outlook may impact future issuance programs and whether there was a risk of a material uplift in issuance over the year. Discussions focused on the outlook for commodity prices, declining household and consumer confidence, the potential impact of house price declines, and the ongoing strength of the labour market and whether wages would increase in line with inflation (and trigger even tighter monetary policy settings). Investors also asked whether the change of government could lead to a material impact on the fiscal outlook.

AOFM messaging

Higher than forecast commodity prices and employment levels are leading to higher than forecast tax receipts – both have been in play for some time now. In addition, a decline in business investment is also contributing to strong tax receipts in the short term. Our cash portfolio balance for 2021-22 finished around $20 billion ahead of forecasts, which is broadly similar to the outcome at the end of 2020-21. It was explained that if the most recent Budget forecasts (delivered in March 2022) correctly reflect the 2022-23 financing task, then gross issuance could be expected to be revised down by a similar amount, but nothing can be confirmed until the next Budget in October.

AOFM issuance strategy

Investors were interested in discussing AOFM’s issuance strategy and whether this will incorporate a long-dated issuance bias, will target a particular portfolio duration, and what the issuance plans are for ultra-long bonds. While most demand in the ultra-long end is focused on the 30-year bond, some investors expressed interest in 15 and 20-year bonds. A few investors also asked whether we would consider issuing longer than 30 years. Some asked why there was little domestic demand for ultra-long bonds with most of this demand in AGS from offshore.

Investors with ultra-long holdings asked about plans for a new 30-year bond. We also saw it as an opportunity to gauge investor feedback on what the appropriate maturity gaps should be between 30-year bonds, with investors generally agreeing that four years is too long but every year would be too short.

AOFM messaging

AOFM will have a familiar-looking program and issuance behaviour as prior to 2020. Expect a business-as-usual focus on supporting demand and liquidity in the 10-year futures basket bonds with a familiar pattern of new lines issued around 12 years to roll into the 10-year basket. AOFM will continue to issue into established bond lines across the curve (including in and around the three-year contract) to assist with liquidity and market functioning and meet investor demand.

The AOFM will continue to support the ultra-long end and will issue into demand. All ultra-long maturities are viewed as issuance opportunities if demand is present. While many investors focus on the 30-year bond, the AOFM made clear it can issue into any bond line in response to investor demand and market feedback.

Trends in investor holdings of AGS

Japanese investors asked several questions about trends in investor holdings. Of most interest was identifying potential marginal buyers of AGS now that the RBA’s QE program has ceased.

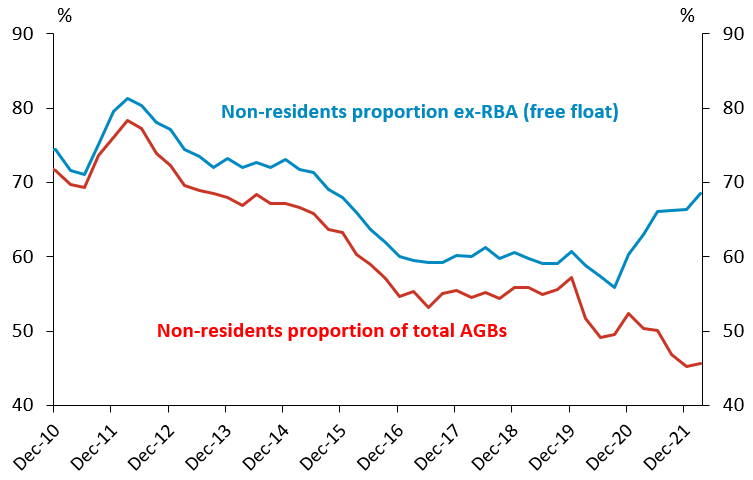

It was explained that we have not seen a structural change in the offshore investor base since prior to RBA bond purchases. As Chart 6 below shows, when the amount of AGS the RBA holds is removed from the total, the proportion held by non-residents is nearly 70%.

Chart 6. Non-resident holdings of Australian Government Bonds

Source: Australian Bureau of Statistics (ABS), RBA, AOFM. Australian Government Bonds (AGBs) comprise Treasury Bonds and Treasury Indexed Bonds.

The investor category that sold the largest amount of bonds that in effect finished up with the RBA were domestic bank balance sheets. Bank balance sheets are required to hold high quality liquid assets (HQLA), which includes AGS, as part of their regulatory requirements. It is expected that bank balance sheet holdings of both AGS and semi-government bonds will increase over the next two-three years. In general, banks hold bonds out to around 10 years maturity, with the offshore investor base the largest holders of longer-dated bonds.

ESG discussions

ESG themes are of increasing importance in Japan, with investors raising the topic much more often than in 2019. While the number of ‘green only’ mandates remains relatively small in Japan, especially compared to Europe, many investors are developing ESG criteria for their portfolios and also look at third party research and country ESG rankings. The AOFM provided investors with summary information on Australia’s updated climate policies, targets, and commitments, which was well received and generated a number of questions about recent changes to Australia’s climate policies. Overall, it seemed clear that there would be interest in a labelled bond should Australia issue one, however few indicated they would pay a significant premium.

Summary

In summary, there remains strong interest from Japanese investors in AUD although current circumstances are not attractive for a large uplift in allocations. That said, when volatility settles, and the rate and yield differentials begin to ‘normalise’ there is likely to be a strong increase in activity. The Japanese investor community see the Australian economy as having strong fundamentals and they remain familiar with the AGS market generally.

There does not appear to be an expectation that the BoJ will alter its monetary policy settings soon although this may change with a change in Governor. In the meantime, the Japanese will be looking more to changes in policies in the major developed market economies as a measure of how to assess their investment decisions.