Issue 9 | AOFM Investor Insights | December 2021 | PDF

Introduction

This edition of Investor Insights considers the potential Treasury Bond market implications of a declining RBA bond purchase program.

Central banks broadened their range of policy tools at the onset of the COVID-19 pandemic. For the RBA this included government bond purchases to support market functioning, achieving a specific yield target (YCC), and injecting liquidity into domestic financial markets through a general bond buying program (typically referred to as QE). Recent economic recovery has allowed many central banks, including the RBA, to either signal or start reducing secondary market sovereign bond market purchases. The RBA has slowed its rate of Treasury Bond purchases from $4.0 billion a week to $3.2 billion a week and announced it will review this operation again in February 2022; at which point it is expected to own around 36% of Treasury Bonds on issue (based on announcements to date).[1]

Withdrawal of RBA Treasury Bond purchases

RBA holdings

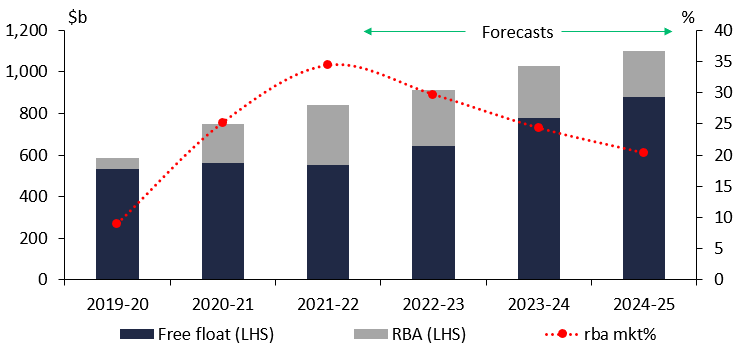

Chart 1 shows actual and forecast Treasury Bonds on issue at the end of each financial year and the RBA holdings as a proportion of the market (with forecasts based on publicly available announcements). Indications for Treasury Bonds on issue are based on MYEFO 2021-22 forecasts and AOFM projections.

Chart 1. Forecast Treasury Bonds outstanding and RBA holdings

Source: Treasury - MYEFO 2021-22, RBA, AOFM

The main points to note are that:

- Since 2019‑20 the ‘free float’ of Treasury Bonds has increased marginally for the AGS market, even as the RBA has increased its holdings to over 30%. However, this does not hold for individual bond lines falling within the RBA bond buying programs given that establishing new maturities has reduced the concentration of AOFM issuance.

- RBA holdings as a proportion of total Treasury Bonds outstanding are expected to decline gradually.

- AOFM gross issuance is forecast to remain elevated compared to pre-pandemic levels.

Outlook for investor holdings of Treasury Bonds

Shifts in investor holdings

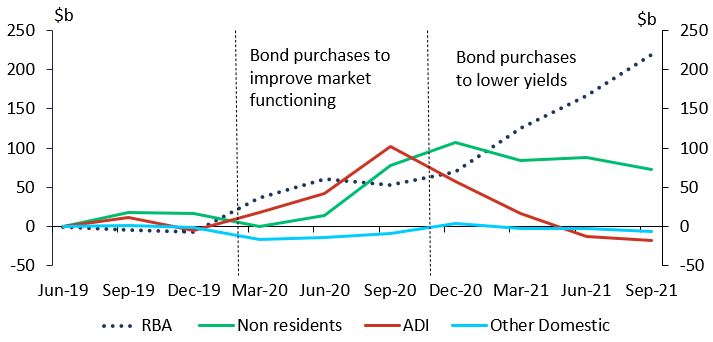

To gauge how different market participants may respond to a further reduction, or cessation, of RBA bond purchases it is instructive to look at how the holdings of different categories of investors have changed since the onset of the pandemic. Chart 2 shows this according to three broad categories of investor (in addition to the RBA).

Domestic banks (Authorised Deposit-taking Institutions) and non-residents began to increase their holdings from March 2020 as AOFM (pandemic related) issuance increased sharply.

Since the RBA commenced its broad bond purchase program in late 2020, ADIs have reduced Treasury Bond holdings to the greatest extent, either by participating directly in RBA tenders or indirectly via intermediaries. In contrast non-resident holdings have fallen only marginally in outright terms, although this is more complex to understand given the influences of foreign exchange and cross-sovereign market yield variations.

Chart 2. Shift in investor holdings of Australian Government Bonds

Source: ABS

Outlook for ADI holdings of Australian Government Bonds

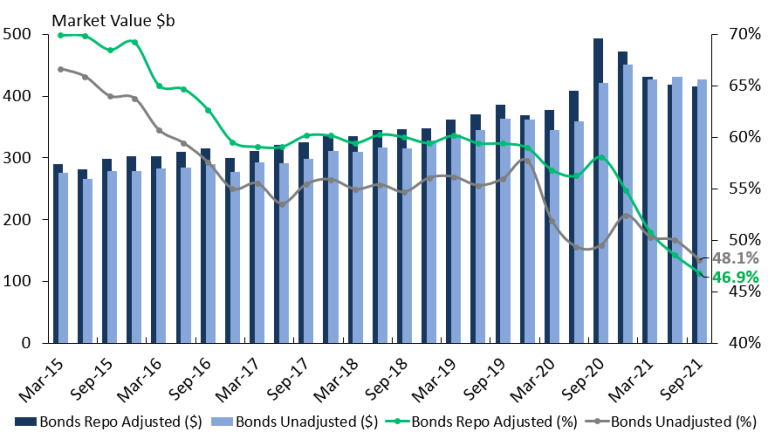

Chart 3 shows that ADI holdings of Australian Government Bonds (AGBs) [2] have fallen appreciably more since late 2020 than their holdings of semi-government bonds. This reflects higher yields on semis, that in turn reduces the HQLA holding costs for ADIs against the alternative of AGBs. ADIs have effectively swapped one form of HQLA (bonds) for another (exchange settlement balances).

Chart 3. ADI holdings of high-quality liquid assets (HQLA)

Source: ABS, RBA

AGB holdings by ADIs as a proportion of the market fell from 26% in September 2020 to 12% in September 2021. While ADIs won’t immediately retrace the unwinding of their AGB holdings in response to an RBA withdrawal from its broad bond purchase program per se, there are several factors which will support a resumption of AGB buying by ADIs.

- Phasing out of the committed liquidity fund (CLF) will require higher HQLA holdings (including AGBs).

- As ADI holdings of the semi market increase, the relatively higher liquidity of AGBs compared to semis tends to become an increasingly important factor in HQLA allocations.

- As short-dated yields rise in line with market expectations for rate rises, short-dated bonds are expected to become increasingly more attractive than ES balances (which currently yield 0% and have always been below the cash rate); and ES balances will necessarily decrease over time as the RBA’s balance sheet is reduced by the maturity of its bond holdings and as ADIs reduce their Term Funding Facility (TFF) liabilities.

- The cost of hedging bonds with futures contracts may fall as bonds become less expensive relative to futures contracts.

Outlook for non-resident holdings of AGBs

Non-residents comprise a diverse group of investors, including official money (the reserve manager arms of central banks), fund managers, pension funds, insurers, hedge funds and banks.

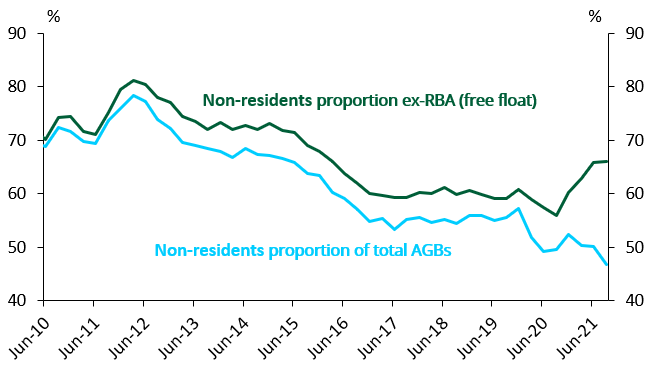

The proportion of AGBs held by non-residents in September 2021 fell to the lowest level since 2004 (Chart 4). In outright terms, however, non-resident holdings have been relatively stable since March 2021 and are higher than they were in June 2020. The proportion of non-resident AGB holdings continued to fall as the RBA broad bond buying program continued.

Chart 4. Non-resident holdings of AGBs

Source: ABS, RBA, AOFM

On a ‘free float’ basis, non-residents hold over 65% of the market excluding the RBA. (Chart 5)

Chart 5. Proportion of non-resident AGB holdings excluding the RBA

Source: ABS, RBA, AOFM

One non-resident investor category that has likely been less active in AGBs since the commencement of the RBA operations are those that fund AGB positions through the repo market. This most noticeably includes hedge funds, although other types of market participants also do this. Chart 4 shows that since March 2021, non-residents have been a net borrower of AGBs from residents (reverse repo) rather than a lender of bonds (borrowing cash to fund purchases of AGBs) as they had done in the prior period. The last time this occurred was in 2014.

There are likely several factors behind this, however the RBA broad bond buying operation has been influential, since by buying AGBs in the secondary market the price of those bonds become more expensive relative to futures contracts. In turn this limits the demand for repo funding to hedge bond purchases using futures (the ‘futures arb’).

Outlook for liquidity

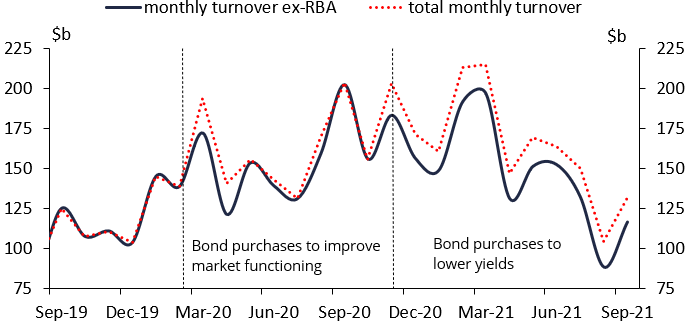

Secondary market turnover provides a general measure of the health of the AGB market. High levels of turnover are usually associated with strong investor demand and competitive two-way pricing by market makers. Chart 6 shows that Treasury Bond turnover increased sharply in 2020, in response to high levels of AOFM bond issuance, but also due to strong demand for Treasury Bonds more generally. The RBA played an important role in restoring confidence to the Treasury Bond market following the dislocation caused by the Covid pandemic in March and April 2020.

Chart 6. Treasury Bonds secondary market turnover

Source: AOFM, RBA

In calendar year 2021, secondary market turnover has declined, although it is still around pre‑pandemic levels (albeit in a now larger AGB market). The effect of RBA operations on turnover has two potential drivers. On the one hand it increased turnover as investors sell bonds to intermediaries who then sell those bonds to the RBA. To the extent this facilitates investors selling bonds of less value to take on bonds of higher relative value to them, this ‘switching’ activity should support overall liquidity in the market. On the other hand, ever increasing levels of central bank ownership of a bond line reduce the ‘free float’ and this can in turn lead to reduced liquidity and, in extremis, dysfunction in bond markets. To the extent this becomes apparent it will: reflect fewer bonds available to trade (for any bond line); put downward pressure on yields (an objective of central bank bond buying); and reduce market maker incentives to take on risk and consistently make tight two-way prices.

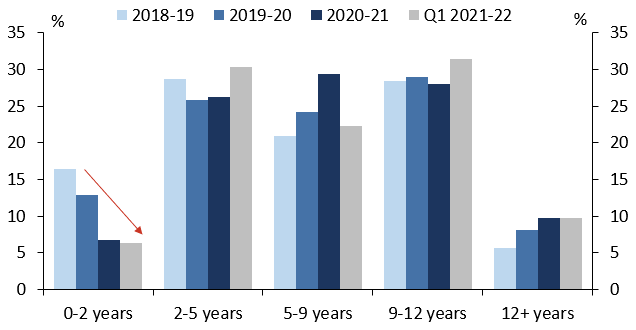

Charts 7 and 8 show that RBA bond purchases has most impacted the very short‑end and parts of the mid-curve. The RBA three-year yield target had the effect of limiting trading and demand for short-dated bonds, both directly and through reduced liquidity of the three-year futures contract. Prior to the various RBA bond purchasing programs, turnover in these bonds was generally lower than for bonds comprising the three and ten-year futures baskets. With the RBA discontinuing YCC in November 2021, the AOFM expects to see a gradual increase in demand and liquidity in this part of the curve, and in large part this will come from those investors who typically hold short duration mandates (a group that includes many reserve managers). Although the AOFM generally is not an active issuer of bonds shorter than the three-year futures contract, there is considerable operational flexibility within the issuance program to do so should this be needed to meet investor needs and/or to improve market liquidity. Furthermore, there are no current plans to resume AOFM buyback operations for short-dated bonds.

Chart 7. Treasury Bonds secondary market turnover by maturity (ex RBA)

Source: AOFM

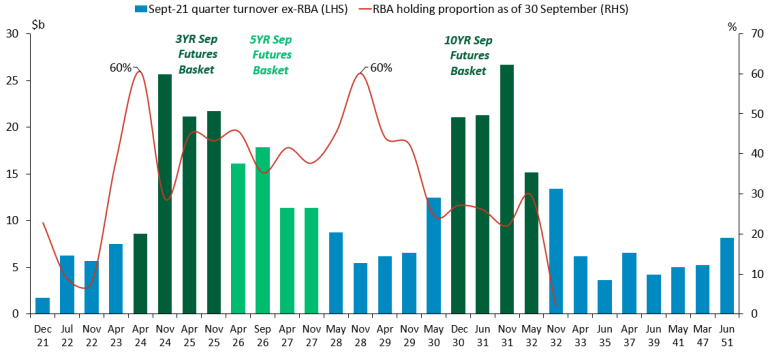

RBA bond purchases can affect the liquidity of individual bond lines. Chart 8 shows turnover by bond line in the September 2021 quarter and RBA holdings as a proportion of each line. The AOFM has only collected a single quarter of secondary market turnover by bond line, so long-term comparisons of individual bond lines cannot be made. The data for the September 2021 quarter shows that high RBA holdings are associated with generally lower turnover, especially for the April 2024 yield target bond but also for several bond lines between the five and ten-year futures baskets. As the RBA withdraws from its broad bond buying program, AOFM issuance will over time result in the free float in most lines beginning to rise. This should improve liquidity – especially for those bonds comprising the 3, 5 and 10-year futures contracts (for which the domestic ADIs have typically provided a solid base level source of demand).

Chart 8. Treasury Bond turnover by bond line and RBA holding proportion (September 2021 quarter)

Source: AOFM, RBA

Turning to the ultra-long end, secondary market turnover data shows a modest increase (from a low base) in turnover in 2020-21. Unlike many other central banks bond purchase operations, the RBA has not included bond maturities longer than the ten-year futures contract. (Charts 7 and 8). This leaves ultra-long maturities exposed to market pricing adjustments (an attraction to many investors) and this may make the adjustment process smoother for this part of the AGB curve compared to other markets, where central banks have purchased bonds out to the longest maturity.

Conclusion

While the RBA’s bond purchasing operations have been relatively aggressive, they have also been short-lived. This suggests that the Treasury Bond market should experience a smooth adjustment process in response to reduced RBA activity when it occurs. Second, there are obvious signs that a combination of reductions in each of the CLF and ES balances will lead to building demand for AGBs from the domestic ADIs (which prior to the pandemic had represented a major source of demand – both for their liquidity management and HQLA requirements). Third, as liquidity increases in both short-end maturities and the three-year futures contract (supported in part by offshore investor demand and AOFM issuance), this will have a positive impact on market functioning, in particular the middle of the Treasury Bond yield curve. Fourth, while the AOFM has become aware of lower levels of investor engagement generally during the past 12-18 months, there has been nothing to indicate the investor base has narrowed because of investors having left the market; therefore, higher levels of engagement will be a consequence of a smooth transition to post-pandemic circumstances, which will in turn be supported by regular AOFM issuance through operational flexibility.

[1] See page 36. RBA statement on monetary policy November 2021

[2] AGBs comprise both Treasury Bonds and Treasury Indexed Bonds