Australian Business Economists Webinar (video recording)

Rob Nicholl, CEO

Thank you to the ABE for hosting this session; it remains an important opportunity each year to set broad AOFM context not easily conveyed through our formal notices.

There are two things I want to cover today: one is the main AOFM learnings from the past several months; and the other is how we are responding to the changed circumstances, with an emphasis on how the market can interpret our behaviour.

There won’t be time to cover implementation of the Structured Finance Support Fund but there is a good amount of detail about this on the AOFM website.

The learnings

It will take deliberate effort for many of us to forget what March was like. I for one am still struck by how quickly we went from a long lead-up of wondering what and when something might happen in markets - to wondering what on earth was going on. It feels like a year or more has been crammed into the few months since then – but hopefully the pace of change slows as the year progresses.

Less than six months ago the AOFM was rationing issuance to best manage a market maintenance objective. Recently we have done little more than mull plans to accommodate the complete opposite; and of course support smaller lenders through the securitisation market.

For many years we have contemplated the consequence of significant funding market turmoil, but could never have been sure as to how it would unfold. In the event, there were key aspects that were very different to what we had contemplated. Temporary loss of access to funding markets is certainly something we had thought possible (and indeed likely at some point), but combined with the scale and timing of the increased pandemic financing task it was a more sobering experience than we could have imagined. Having never faced the step change in issuance that has emerged, it was difficult to assess what lay ahead; something that had not previously been tested for AGS. Although it can be argued the increased volume of AGS issuance required will be manageable overall, the task ahead and the rate at which it needs to be achieved will rely heavily on the engagement of offshore investors, all with a range of investment choices. It was also far from clear in March/April just how much of our past experience could be applied in this new dynamic, and so the way forward did not look familiar. Something that did stand out was a heightened sense of feeling like we were the ones standing between urgent commitment and timely delivery. I remember thinking it is sometimes tougher to look than to leap. To date this been the case. Let’s hope it stays that way.

As to the key learnings there were four I will cover: (i) the prudence of holding excess cash balances; (ii) the utility of the Treasury Note market; (iii) how well the yield curve extension has served us; and (iv) the usefulness of syndications.

Maintaining a reasonable liquidity buffer has never been something in doubt; however, deciding what constitutes ‘reasonable’ has not been as straightforward. While our thinking on this has varied over the years, it is a question that has always come down to a judgement that balances the risk of not being able to meet the government’s outlays, against the costs of carrying excess cash. With only the GFC experience to look back on it has been hard to judge how long a loss of market access might extend. Amongst numerous alternatives we have adopted as a benchmark the aim of carrying sufficient liquidity to cover forecast outlays for at least four weeks without access to financing. Furthermore, our scenario planning had assumed a severe restriction on issuance lasting a couple of weeks at most, regardless of what might be happening elsewhere in markets. While this in effect turned out to be the case, there are two things we hadn’t fully anticipated. One is the extent to which widespread investor-selling of AGS would create extreme market congestion, and added to that the time it would take for investors to meaningfully re-engage, particularly offshore investors. Furthermore, the scale and speed of the build-up in outlays resulting from the pandemic related fiscal response is not something we could have foreshadowed.

We will never know how long the market would have taken to recover had the RBA not intervened. While having liquidity to at least meet ongoing outlays into April, it would not have been sufficient to cover the start of the government’s pandemic response, a deterioration in the underlying revenue position, and the volume of bond buy backs required to clear intermediaries’ trading accounts. In principle a long enough suspension of issuance should allow the market to clear, but there was no way of knowing at the time how long that would require.

While not perfect in comparison, the linker market recovered without RBA intervention, although that took several months even with the AOFM fully suspending issuance. But we could only afford to do that because linkers are not providing a meaningful contribution to the financing task.

An ability to rely on the cash market in a time of crisis was also an important observation. Since the Treasury Note market was reopened during the GFC our reliance on it has waxed and waned, depending on various considerations that have been covered in past speeches. In the absence of a specific vision for this market, just keeping it open for a time of crisis has become the default, regardless of whether it was relied on regularly in the meantime. This is because in periods of severe stress we expect investors to retreat to positions of high liquidity, while at the same time avoiding duration risk. A corollary to this is that Treasury Notes will offer the safety of cash, but with a marginally better return.

Throughout the turmoil of March and April the Treasury Note market indeed remained open and the continued strength of weekly tenders indicates why we have been able to lean on it to the extent we have. The result of course has been a sharp run-up in the volume outstanding.

Chart 1: Issuance of Treasury Notes

The left-hand graph on this chart shows the change in total T-Note volume outstanding between MYEFO and today. The right‑hand graph shows the increased number of maturities over the same period. To gauge some perspective on these changes, the volume outstanding as of today is $64 billion while at MYEFO we were expecting a peak for 2019-20 of around $20 billion.

The increase in volume outstanding still has some way to run but we are not releasing estimates because they will continue to change, and because we need to retain operational flexibility. Publicly locking in the overall mix of financing will take that flexibility away. Treasury Notes will continue to play an important role throughout this year and well into next year at the very least. This is because the size of the funding tasks ahead mean that it will be next year at the earliest before we can noticeably begin to refinance Treasury Note volumes through bond issuance.

Extending the yield curve to 30 years has also proved useful. As of March, bond lines of 13 years and longer had accommodated 12 per cent of the nominal debt portfolio. Had that $63 billion in stock been spread only out to the 10-year futures basket, the recent market congestion would have been materially greater. The yield curve extensions have also relieved the pressure on funding tasks by reducing the volume of debt maturing each year needing to be financed. Of course prior to the March market dislocation the AOFM had spent many years deliberately extending the duration of the long-term debt portfolio, including the yield curve extension. What in large part drove this was thinking about how we would want to be positioned in the event of a crisis – that is, ideally with a materially lower annual debt refinancing burden. Broadening the investor base was another driver and together they have always been expected to add to market resilience.

In the event, the lengthening strategy commenced in 2012 has reduced the funding task over the next few years (relative to the pre-lengthening status quo) by about $25 billion per year. In other words, the issuance programs last year and this year would have been about $25 billion higher had that portfolio lengthening not occurred. The regular Treasury Bond buyback program provided additional support to this aim by effectively switching short-term debt for longer maturities.

The importance of the long-end of the yield curve is also highlighted by the success of the new 2051 bond line this week. The long-end encourages a broad investor base and heightens offshore investor engagement. Testament to this is that initial syndications for the 2047 and 2051 benchmark lines attracted about 120 and 150 participants respectively. This compares with about 58 on average for all other syndications.

Chart 2: Treasury Bond

You can see from this chart how engaged the offshore investor cohort has been in this part of the market. Each syndication since 2012 is included here and transactions that extended the yield curve have been highlighted by print volumes in [red]. The [light blue] bars show allocations to domestic investors, the [dark blue] allocations to offshore investors – with trading bank allocations shown by the [grey] bars. The chart shows that, for example, the 2033 syndication in 2013 (3rd from LHS), which created the first 20-year benchmark bond line, had a print volume of$5.9 billion and an allocation to offshore investors of about two-thirds. The 2047 syndication in 2016 had a print volume of $7.6 billion with an allocation again to offshore investors of about two-thirds. The 2051 (on the RHS) had a print volume of $15 billion (how can we forget) also with an allocation to offshore investors of about two-thirds. It would be too obvious to say there is a theme underlying these yield curve extensions but the consistency is hard to ignore.

Interestingly most of the March congestion arose from investor selling of maturities out to about 10 years. Although there was significant investor selling across the curve, the focus was on bonds between the three and 10-year futures baskets. And while it didn’t seem the main action at the time we know that investor positions in ultra-long maturities were also unwound. In any case, the long-end of the market also recovered without the need for RBA intervention but again this required a prolonged period of targeted issuance suspension.

The last key learning I will touch on is the utility of syndications. As the market was recovering during April and May, each of the new 2024 and 2030 bond line syndications allowed large volume testing of the market without the execution risk of an uncovered tender. At the same time they gave valuable insight into investor views on AGS.

The importance of these transactions in gauging market conditions via investor appetite for duration risk and volume in AUD fixed income cannot be overstated. Syndications continue to complement the importance of our regular market liaison but after the turmoil of March they really helped to reinforce a view that an early start to the large issuance task ahead could be smoothly achieved. The sequencing of them also allowed us to follow recovery of the market as trading liquidity gradually improved from the very short end toward the 10-year futures basket.

The launch this week of the new 30-year benchmark bond has now given us better visibility into the dynamics of the ultra-long-end of the yield curve, and as we just saw in the previous chart it highlights in particular the underlying strength in demand from the offshore investor base. A number of factors drive this and there will be wide-ranging views as to what factors are more or less important. However, our view is that a strong sovereign credit rating, attractive yields, transparency in the market (including consistent clear messaging from the RBA), active support from intermediaries, and up-to-date issuance guidance combine to promote investor confidence.

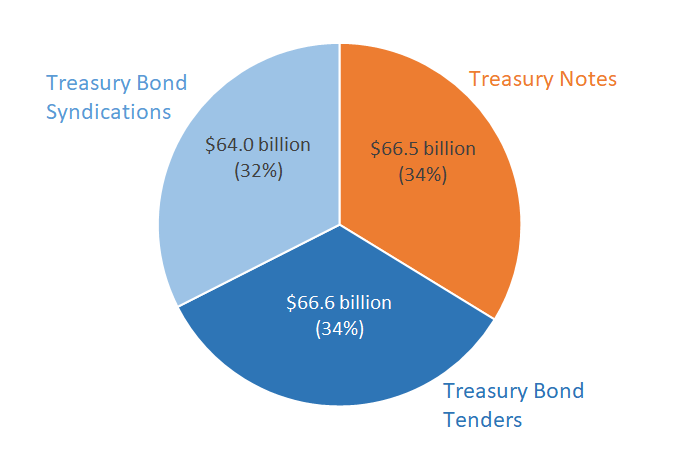

Chart 3: Breakdown of Issuance since April 2020

This chart shows the mix of funding approaches we have used since the beginning of April. Syndications (including the one this week) have been used to raise 32 per cent, while bond tenders and Treasury Note issuance each provided half of the other 68 per cent of funding raised. It won’t come as a surprise that syndications are to remain an important issuance method over the remainder of the year, not least because they offer an effective means of accelerating the issuance program.

While improved market conditions are expected to persist for some time, we will continue to closely monitor the quality of bond tenders for signs that the issuance rate could be exceeding levels of demand that can consistently support smooth absorption of large tender volumes. A persistence of declining coverage ratios, widening price spreads or longer tender tails are all indicators to watch out for. Over time we could also expect faltering demand to be reflected by rising yields, but while AGS yields are indeed a function of the amount of planned and actual issuance, they are also a function of conditions in other markets – sometimes making it hard to read the macro drivers of yields in AGS. The extent to which trading accounts are warehousing bonds is also an important factor. These factors can combine to make it difficult at times to interpret why yields may have moved as much as they have, or alternatively very little at all. We would also be looking to understand widening in bid-offer spreads. These are some of the reasons we use a range of indicators and close market liaison to inform issuance decisions. They may also help to explain our caution at times when relying too heavily on the recent past and current circumstances, challenges what our in-built conservatism would otherwise tend to encourage.

Issuance for the year ahead

Let me now turn to our issuance plans.

On the 3rd of July we announced a weekly issuance rate for Treasury Bonds of $4-5 billion, with a weekly rate of issuance for Treasury Notes of $2-4 billion. We are confident this guidance will be reliable until the October Budget; absent of course a sharp unanticipated change in the fiscal position. Last week the Treasurer announced an estimated fiscal outcome for 2019-20 and a forecast for this year. Although we typically follow a pattern of updating the market on planned issuance after official updates, this year has been different for the obvious reason that official updates have been delayed. With the impact of the pandemic still unfolding and there being no assured means of anticipating what lies ahead, forecasts will continue to change. That said, we are planning to transition back to the standard way of updating the market and aim to start from the next update immediately following the Budget.

Although to date we have only announced a weekly issuance rate and new maturities, the current plan for gross Treasury Bond issuance this year is around $240 billion. This will comprise about $50 billion to fund maturing debt and $190 billion of net new issuance. This is materially higher than the $128 billion issued last year, although almost $90 billion of that was issued in the last quarter. This issuance rate together with a number of syndications will allow us to ‘front-load’ the program. Given the potential for heightened uncertainty in the outlook, staying clearly ahead of the issuance task this year will be wise.

In terms of our approach to issuance, the past is likely to be a good indicator of what lies ahead. Looking back a few years at what were then considered relatively high issuance programs we typically held several tenders for Treasury Bonds each week. One tender would target a shorter maturity in the vicinity of the three-year futures basket, with another targeting a longer maturity usually around the 10-year futures basket. The obvious reason for this is that over many years these have been the most liquid sectors of the yield curve. Not a lot has changed in this regard so we will need to rely heavily on mid-curve and 10-year bond issuance to achieve our funding task.

An overlapping consideration is the coming launch of a new five-year Treasury Bond futures contract, which in our view will provide additional structural support for the AGS market. It will create new trading opportunities and hopefully increase investor interest in that part of the yield curve. Most of the bond lines to support this new contract already exist but it seems sensible to assume the initiative will enhance liquidity in this region of the curve.

Five new Treasury Bond lines were announced for this year and once again I highlight that the process will be familiar to the market. Some years ago when issuance tasks were building we introduced additional bond lines in support of the three-year futures contract basket. As issuance continued to build we extended this to the 10‑year futures basket. Then as issuance declined the number of new bond lines was reduced accordingly. But current circumstances have clearly created the need for us to revisit the multiple new line strategy.

Chart 4: Treasury Bonds on Issue

This chart shows Treasury Bond lines outstanding as at 1 July last year [dark blue bars] and issuance since then [light blue bars] current as of today. The pattern of issuance around the futures baskets I described stands out clearly. The 10-year basket attracted a lot of issuance last year and at MYEFO the average-term-to-maturity of issuance was around 12 years. March-April put a stop to maintaining that as an issuance strategy with the three-year futures basket having again been elevated in significance. The result for this was that the average-term-to-maturity of issuance for last year finished up at around nine years – the lowest for quite some time.

Chart 5: Treasury Bonds on Issue

The now familiar approach to introducing new bonds is also clear from this chart, which shows the new lines introduced since early April and several more to be introduced during the remainder of the year.

Another thing to note is that some of these bond lines are now becoming large with nine bond lines each over $30 billion on issue.

This raises the question as to how much larger these lines will get over the coming years, although we never have nor are we about to cap the size of bond lines. An alternative is to introduce third within-year lines. There are several reasons for considering this. One is that large lines will add complexity to meeting bond maturities from a cash management perspective, not to mention the potential impact this may have on the RBA’s task of managing system liquidity. Another reason is that marginal liquidity benefits are likely to dissipate after bond lines reach around $30‑35 billion. Additional bond lines should also create new interest from investors. While confident this is something worth pursuing we will continue our thinking on it with a view to giving more specific guidance after MYEFO.

To round this part of the update out I will briefly return to the long-end of the curve. We continue to see opportunity for developing this part of the market and will continue to hold appropriately sized tenders and smaller syndications to tap existing lines when the opportunity arises – although our previous guidance on tap syndications at around $2 billion is now revised as a range of up to $6 billion. The main point I want to make though is that our overall objective of maintaining a well-functioning 30-year yield curve has not changed. This means the long-end remains important but we will also recognise that it is not a part of the market on which we can regularly rely for high-volume issuance in the absence of a material change in demand. But the result this week is noteworthy and we will continue to monitor market developments closely and respond to opportunities as they arise.

With respect to the 20-year futures contract, continued AOFM support should not be in question. However, no new maturity is planned for this year. For the purposes of 2021-22 we will decide whether a new 2043 or 2044 bond line will be the next appropriate 20-year futures basket maturity.

The future of regular Treasury Bond buy-backs will remain open but they will not be reintroduced this year given they need to be funded by new issuance. Whether or not this happens next year will depend on the size of the issuance tasks required for Budget and related financing, and the rate at which we decide to ‘term out’ Treasury Notes.

This leaves the linker market to comment on. Our guidance of 3rd July should have made clear that we are planning for a business as usual approach with two tenders of around $100-150 million a month. The next new maturity will be a 2032 or 2033 but the best timing for this remains unclear. We are not at this stage planning for it before next year at the earliest. Until then we will do our best to support liquidity in the linker market although we see no case in the current circumstances for a material change in gross issuance of around $2‑2.5 billion per year.

I will finish by making some summary observations.

Australia has a strong balance sheet and financial markets appear to be judging the country as one that reflects consistency in good governance and with prudent fiscal management – in fact the sovereign credit ratings are a reflection of the combination of these and other relevant factors. I also think there is little doubt that Australia has been judged as having managed the pandemic well – investors understand this and have reacted accordingly if we are to take the strength of recovered engagement in the AGS market as any indication.

The financing tasks ahead are large but should be manageable under current market conditions, with an expectation that these conditions should persist for the foreseeable future. It is difficult to compare AGS issuance related opportunities and challenges from pre-March within the current context. In my view markets have changed a lot in the past few months and we now find ourselves in a different dynamic with our thoughts and views on a range of things having been recalibrated as result of those changes. It will seem strange to some but the costs of maintaining a robust, functional and reasonably sized sovereign bond market are clearly worth it. I think we made a similar observation after the GFC but recent events have again highlighted the benefits of having familiar and orderly access to funding markets. As I noted earlier however, getting through the funding tasks ahead smoothly is really going to be more a function of the rate rather than the scale of the issuance programs. That is obviously something for AOFM to manage.

Lastly, anyone would hope that an event like what we have recently experienced is only ever part of scenario planning, but if it does occur we will feel thankful for a prolonged discipline that has provided a strong basis on which to meet the challenges. I think that test has been met, but not without some notable learnings. It can be difficult for others to understand the dynamics of some of these challenges from an AOFM perspective and I feel we have at times been judged as overly cautious in our approach. However, I would rather the AOFM be seen as too conservative than under-prepared.

Thank you