Issue 7 | AOFM Investor Insights | April 2021 | PDF

This edition of Investor Insights considers the role of Treasury Indexed Bonds (TIBs). TIBs comprise only a relatively small part of overall financing, however they do assist the AOFM through increasing overall AGS investor diversity. This role was generally more important in the early post-GFC years than has been the case in recent years. TIBs offer inflation protection to investors with principal and interest payments both linked to changes in the consumer price index (CPI). Although TIBs only represent a small proportion of the AGS debt portfolio, this is also the case in most countries with sovereign inflation-linked bond markets (see below).

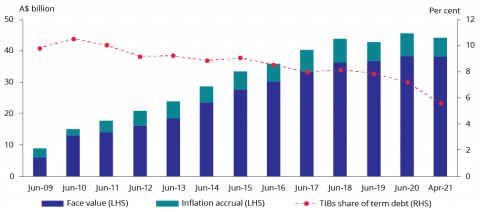

Chart 1 shows that the stock of TIBs has steadily increased since the AOFM reopened the market in 2009. The share of TIBs as a proportion of long-term debt has, however, fallen as increased borrowing requirements since the GFC have been met primarily from Treasury Bond (TB) issuance (while TIB issuance has been relatively static).

Chart 1: Treasury Indexed Bond share of long-term debt

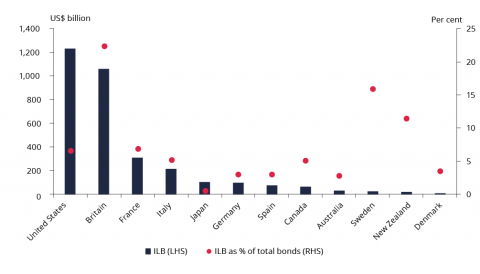

Chart 2 shows Australia as one of only 12 developed sovereign inflation-linked bond (ILB) markets.[1] The US and UK have the largest markets. For most sovereigns, the proportion of ILBs is relatively small compared to their total bond market.

Chart 2: Sovereign inflation-linked bonds

Key Insight: Inflation‑linked bond markets are small compared to total term funding markets.

Treasury Indexed Bond market liquidity

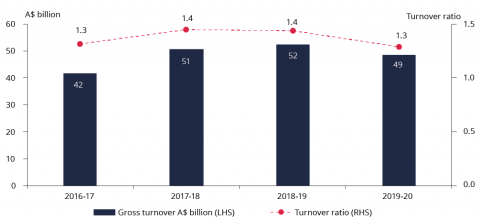

The TIB market is consistently less liquid than the TB market. There are several reasons for this but they revolve around there being a narrower investor base and fewer active price makers. Furthermore, many investors, especially in longer-dated TIBs, tend to 'buy and hold' TIBs rather than trade them frequently. Nevertheless, feedback from many investors is that the liquidity of the TIB market compares favourably to other similar-sized markets. Chart 3 shows that annual secondary market turnover has been around 1.3 to 1.4 times the average amount on issue over the last four years. Indications are that turnover in 2020-21 could be higher, with around $31 billion of turnover recorded in the first two quarters alone – implying an annualised turnover ratio of around 1.7.

Chart 3: Annual TIB turnover

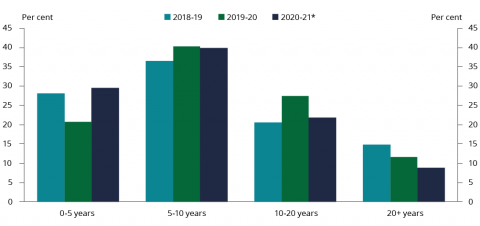

Chart 4 shows that the most liquid part of the TIB curve, as measured by secondary market turnover, is in the 5-10 year sector (similar to the TB market where the 10-year is also the most liquid point). The liquidity in the 5-10 year sector is supported by primary issuance for the 2020-21 financial year (up to end April 2021), where 72 per cent of total issuance has been in the 2027 and 2030 bond lines.

Chart 4: TIB turnover by tenor

Key Insight: The TIB market is relatively liquid by global standards and is most liquid in the 5-10 year sector.

Treasury Indexed Bond investor base

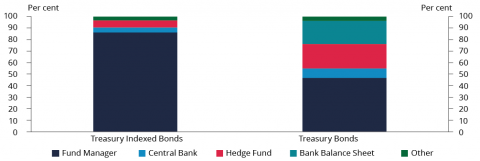

TIBs and TBs are sufficiently different such that they each have clear and distinct investor bases, albeit with some overlap. TIB investors include asset and liability managers with long-dated liabilities with a need to manage inflation exposure. These investors are more likely to hold longer-maturity TIBs.

Chart 5 shows how the fund manager category has dominated TIB syndications (with a high degree of confidence that this reflects the broad holding pattern of TIBs over time). Across all deals, excluding trading banks, around 86 per cent of syndicated issuance has been allocated to fund managers. This includes insurance funds, defined benefit and defined contribution pension funds, and other asset managers. Within the fund manager category, around 81 per cent has been allocated to domestic investors compared to an overall domestic allocation of 70 per cent.

Chart 5: Syndication data – represented investor types (excluding trading banks)

From a geographic perspective, offshore investors comprise a much smaller proportion of the TIB market than the TB market. The higher concentration of domestic investors is reflected in Chart 6. Market makers report that around 60 per cent of TIB secondary market turnover is domestic-originated (see Chart 6). The proportion of domestic holders of TIBs is likely to be at least 70 per cent, with more domestic investors maintaining a buy and hold strategy, especially in long-dated TIBs (15 years and longer).

Chart 6: TIB turnover by region (excluding interbank)

AOFM support for the market

The AOFM has provided ongoing support for the TIB market. Market development has been demand-driven, including the development of the TIB curve to 30 years, maintaining a 10-year benchmark bond and building lines to a liquid size. Support has also been reflected by: regular issuance and varying gross issuance volumes from year-to-year); operational flexibility (including changes to tender arrangements, buybacks, and introducing in-fill maturities); and regular in-depth market engagement. In addition the AOFM securities lending facility assists secondary market liquidity by allowing market participants to borrow TIBs when they are not readily available from other sources in the market.

Regular issuance

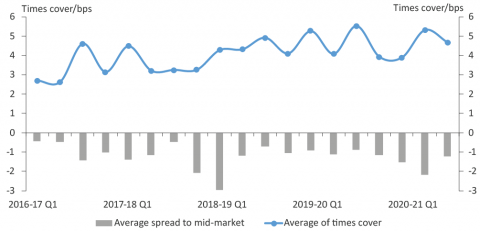

While syndications are a highly effective method for establishing new TIB lines, and are major liquidity events, regular issuance by tender is the primary method of TIB issuance. Tenders are usually held twice monthly, with volumes and maturities taking into account market feedback. Regular tenders (usually $100-$200 million) provide a consistent and demand-driven liquidity injection to the market.

Chart 7 shows that TIB tenders have generally been well covered even at or below the secondary market mid yields. The AOFM seeks to balance meeting investor demand for TIB supply, while not issuing at a rate that would strain the ability of market makers to absorb the issuance.

Chart 7: Treasury Indexed Bond tenders - times cover and spread to mid

Flexibility

Operational flexibility has included responding to market demand in terms of issuance volumes (often announced as a range), the choice of TIB maturity selected for tenders, introducing news lines and conducting buybacks of near–maturing TIBs. It also means being flexible in times of market dislocation, such as that which occurred in March and April 2020, where AOFM paused issuance for around two months to allow the market time to recover. Some years ago, in response to investor feedback, tenders were moved from once to twice a month, and pricing was changed from single to multiple price tenders.

Market engagement

Compared to TBs, the smaller number of TIB investors means the AOFM can engage more regularly with a larger proportion of TIB investors. The AOFM speaks directly with around ten domestic TIB investors on a fortnightly basis. These calls provide timely feedback on conditions in the TIBs market when selecting individual lines to tender. Also, periodic (annual) 'round tables' are hosted by a bank with domestic TIB investors and the AOFM.

‘Primary investor calls' are also conducted following each Budget update, with around 20-30 domestic investors and 50-60 offshore investors. Many of these investors would either be existing TIB holders or have a strong interest in the market.

Key Insight: The AOFM can be more flexible with TIB issuance because it represents a small part of the AOFM’s funding task.

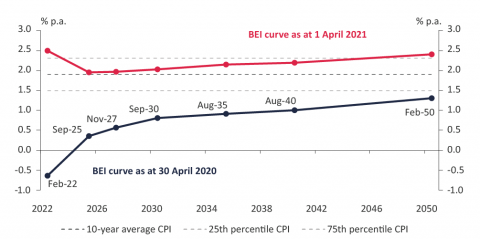

Taking a long-term approach to the market

Investor appetite for inflation protection has been tested in recent years both in Australia and globally as inflation outcomes have been consistently below long‑term averages and targets set by central banks. More recently, there are signs that inflation expectations are for increasing CPI rises. One way market inflation expectations can be observed is through the difference in yield between nominal (TBs) and real (TIBs) yield curves of the same maturity – known as the breakeven inflation (BEI) rate. Many investors with a nominal return benchmark can hold TIBs if they perceive relative value between nominal bonds and TIBs. These 'breakeven' investors can be beneficial for generating liquidity in both markets.

Chart 8 shows how the BEI curve has shifted up over the last year from being at record lows to now broadly in line with 10‑year average CPI outcomes and the RBA’s inflation target of 2-3 per cent on average, over the medium term.

Chart 8: One year change in BEI curve and CPI outcomes over ten years

The AOFM monitors a range of indicators closely to form judgements for appropriate levels of gross issuance relative to ongoing underlying demand; this takes account of the activity associated with relative value investors in TIBs. These judgements also include consideration of the cycles of offshore interest that tend to come and go over time depending on the attractiveness of the TIB market relative to other sovereign inflation-linked markets. While increased foreign demand creating large ‘shorts’ would be responded to by the AOFM, it may not necessarily be a signal to increase proportional supply (through markedly higher gross issuance volumes). On the other hand, greater 'structural demand' in which investors' risk and return objectives were linked to CPI or a TIBs based benchmark would give greater confidence the market could maintain a larger TIB program.

The AOFM remains committed to supporting and maintaining a functional and liquid TIB market that supports a diverse group of investors.