Issue 14 | AOFM Investor Insights | February 2024| PDF

Introduction

This edition of Investor Insights is about the Australian Office of Financial Management’s (AOFM) Green Treasury Bond program. In January 2024, the AOFM announced plans to issue the first Green Treasury Bond between April and June 2024. The bond will mature in June 2034. The bond size will depend on the number and scale of eligible green expenditures selected for green bond financing.

This paper discusses:

- the rationale for issuing green bonds

- the important role of investor engagement in developing the Green Bond Framework

- the progression towards the initial issue and the outlook for the green bond program.

Background

In April 2023, the Australian Government announced the introduction of a Sovereign Green Bond program. The green bond program is a priority of the Australian Government’s broader Sustainable Finance Strategy, which sets out measures to increase transparency and credibility of green finance markets. The consultation paper was released in November 2023.

The AOFM published the Green Bond Framework and accompanying Second Party Opinion (SPO) report in December 2023. The Framework outlines the Australian Government's climate change and environmental priorities and how green bonds will finance eligible expenditures. This includes the basis for identifying, selecting, managing, and reporting on spending financed with green bonds. The AOFM and Treasury consulted widely with domestic and international investors, other sovereign green bond issuers, and market participants to assist in developing the Framework.

Issuance of Green Treasury Bonds

Green Treasury Bonds are identical to regular Treasury Bonds, but the proceeds of green bond issuance will be allocated to Eligible Green Expenditures that meet the Green Bond Criteria set out in the Framework. The bonds come with additional monitoring and reporting. Green Treasury Bonds will form a part of the broader debt issuance program.

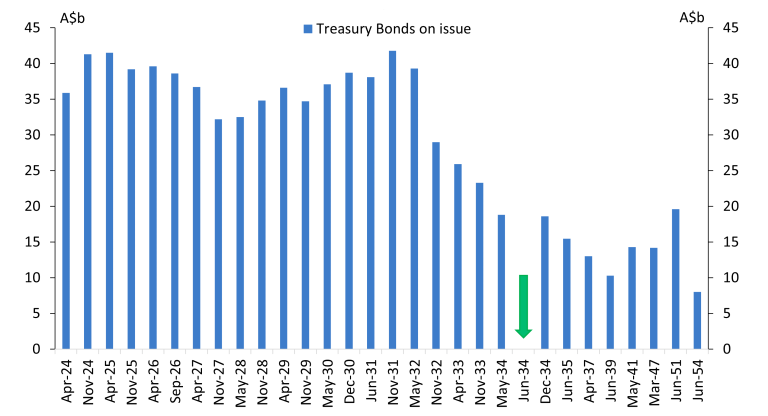

Chart 1 shows that the first Green Treasury Bond will be issued at around ten years in tenor and be just longer than the existing May-34 bond line.

Chart 1: Treasury Bonds on issue

Source: AOFM as of 31 Jan 2024

The rationale for issuing green bonds

In 2022, the Australian Government updated its legislated Nationally Determined Contribution (NDC) under the Paris Agreement, committing to achieve net zero emissions by 2050 and reducing emissions to 43 per cent below 2005 levels by 2030. Australia's transition will be capital-intensive and require significant investment. To achieve these objectives, the Australian Government has committed to a substantial pipeline of investments, many extending over multiple years. It is likely that new projects will be developed over time.

The launch of a green bond program will achieve several pivotal objectives. It will:

- boost the scale and credibility of Australia’s green finance market and attract more green capital to Australia by increasing transparency around climate outcomes and the scale of green investments available

- enable investors to back public projects that drive Australia’s net zero transformation and support environmental objectives

- increase transparency and improve sustainability-related reporting by public sector entities

- contribute to further diversification of the AGS investor base.

Sovereign and Australian green bond market

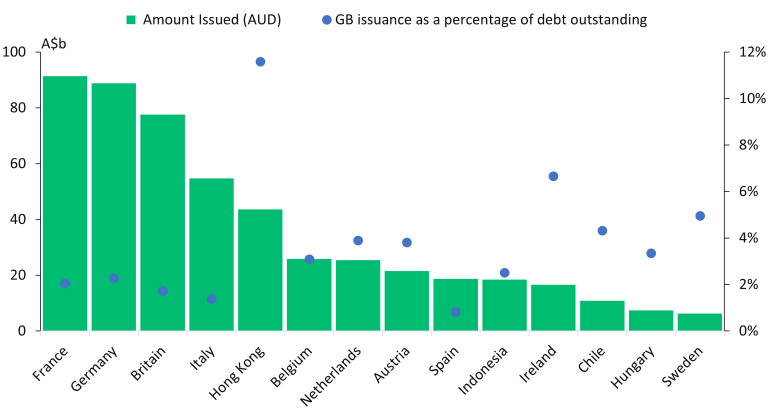

Internationally, around 30 sovereigns have issued green bonds, and several others have announced plans to issue green bonds in the future. Green bonds form a modest proportion of the debt portfolios of these sovereigns, averaging just over 2.5 per cent of their outstanding debt. Other sovereigns have issued sustainability bonds, which are used to finance eligible expenditures with both environmental and social themes.

Broad engagement with active sovereign and semi-government green bond issuers, together with investors experienced in assessing sovereign green bond programs has helped Australia incorporate lessons into our own program.

Chart 2: Green bonds issued by sovereigns and proportion of debt outstanding.

Source: Bloomberg, as of 24 Jan 2024

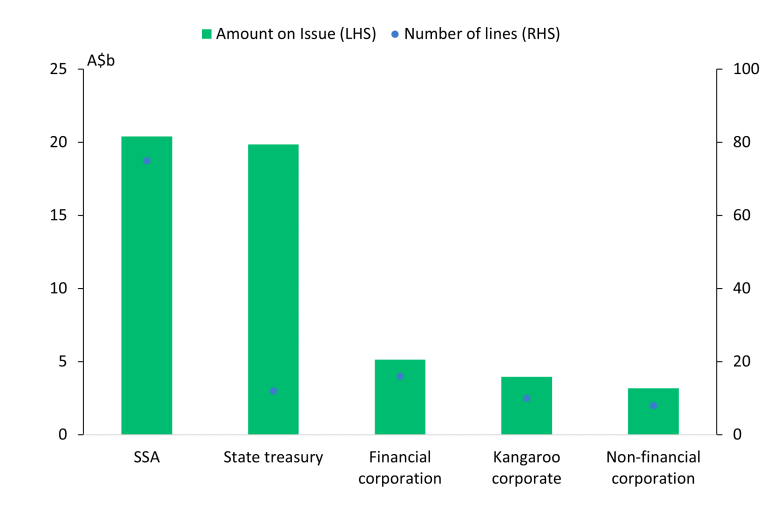

The Australian green bond market has grown substantially over the past decade. There is an established Australian dollar green bond market and investor base for green bonds issued by SSAs, state governments, and corporate issuers. The sovereign green bond program will significantly amplify the scale and reach of the Australian green bond market.

Chart 3: Green bonds issued in Australia dollars*

Source: Bloomberg, as of 31 Jan 2024

*Kangaroo Bonds are Australian dollar-denominated bonds issued by non-resident entities in Australia.

The Green Bond Framework

The Green Bond Framework sets out the Government’s climate change and environmental policies and outlines how green bonds will be used to finance eligible green expenditures. This includes:

- the types of projects and expenditures that can be financed or refinanced with green bonds

- processes for project evaluation and selection

- how proceeds will be managed, tracked and monitored

- ongoing reporting on the allocation of proceeds and the impact of the projects.

Consultation with investors, climate and nature policy experts, and state and international green bond issuers helped in the development of the Framework. It has been developed in accordance with and is compliant with International Capital Market Association (ICMA) Green Bond Principles and is informed by the Climate Bonds Initiative’s Taxonomy.

The Framework details that eligible projects and expenditures financed by Green Treasury Bonds must align strongly with one or more of the Australian Government’s three key green goals, which are:

- Climate change mitigation

- Climate change adaptation

- Improved environmental outcomes.

Investor input into the Framework

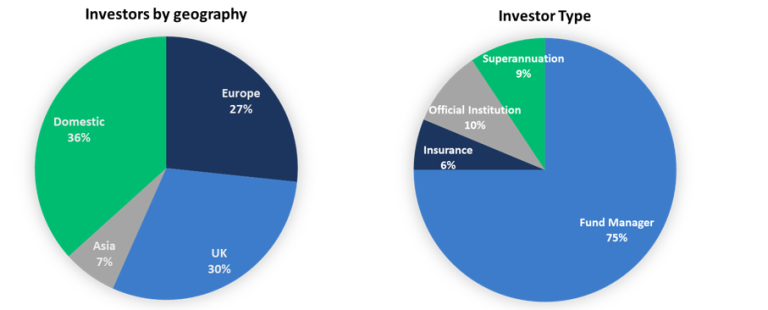

The AOFM and Treasury jointly conducted a round of formal engagement with over 40 investors to inform the development of the Green Bond Framework and the issuance program. The consultation involved in-person and virtual meetings focused on aligning the Framework to international standards, issuer-level credibility, eligible expenditures, exclusions, lookback periods, allocation periods, and reporting.

Chart 3 shows the diverse group of investors consulted. Investors consulted covered a broad spectrum by type and region and by their focus on environmental policies and programs.

Source: AOFM

Many investors consider the climate and environmental credentials of the issuer as a prerequisite for deciding whether to buy a green bond. For this reason, a sovereign green bond program aligned with the Government’s policies and commitment to climate, energy, and other environmental goals adds credibility to the green bond program.

Key messages from investors about the Framework

- Alignment of the Framework with the ICMA Green Bond Principles is considered a minimum standard, with the Climate Bonds Taxonomy and sector criteria, and United Nations Sustainable Development Goals being well-regarded.

- A broad range of eligible expenditure categories are supported, especially if they address key environmental issues for Australia.

- These include projects and expenditures that mitigate and reduce carbon emissions, support adaptation to the impacts of climate change, and support improved environmental and biodiversity protection.

- Many investors are highly focused on the forward-looking impact of their investment and tend to favour new eligible projects and expenditures, which will be funded over the next few years. Nevertheless, investors are supportive of a 12-month lookback period for existing eligible projects and expenditures.

- Research and development expenditure is broadly supported provided it makes up a relatively small share of the eligible project pool and can meet the requirements for post-issuance reporting.

- For some investors, ‘transition’ related funding can be acceptable if there is a clear narrative about how a project may help transition away from fossil fuels. However, projects related to development, refining and transportation of fossil fuels, as well as programs that predominately assist Australia’s highest greenhouse gas emitting facilities have been excluded from the Green Bond Framework.

- Regular allocation and impact reporting is essential for investors to form their own assessments and reporting; this includes social co-benefits for impact reporting.

Key messages from investors on structural characteristics of green bonds

- Investors would like the bond to be liquid, preferring a small number of larger lines and building liquidity over time through regular tenders.

- A tenor of around ten years is most preferred.

- Investors prefer multiple maturities and developing a green curve in the longer term.

Where are we, and what are the next steps?

Green Bond Program timeline

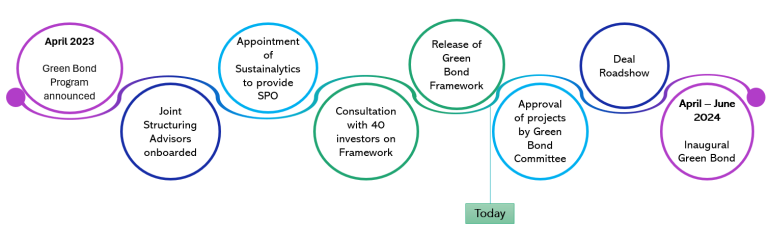

With the Green Bond Framework and SPO published, the next steps entail endorsing eligible green projects and expenditures by the Green Bond Committee, a deal roadshow, and finally, the first Green Treasury Bond syndicated issue.

The Green Bond Committee has been established as an interdepartmental committee to support a robust governance process for eligible project evaluation and selection. The Committee’s role includes oversight of the Framework, endorsements of Eligible Green Expenditures against the Green Bond Criteria, oversight of allocation and impact reporting, and risk management.

A green bond roadshow will be conducted in Australia and international locations. In addition to marketing the green bond to investors, the roadshow will provide an opportunity for in-depth discussions with investors about the Green Bond Framework, projects that will be funded, and more details of the syndicated issue.

The first Green Treasury Bond will be issued via syndication between April and June 2024. The bond will mature in June 2034.

The Green Treasury Bond program

The AOFM will issue the Green Treasury Bond and manage the overall green bond program in such a way that it appeals to the widest range of investors possible. This includes:

- issuing the first bond into the most liquid and in-demand part of the curve – around 10 years in tenor

- achieving a balance between the initial issue being large, while leaving capacity for further smaller tenders

- developing a ‘curve’ in subsequent years by establishing new green bond lines

- continuing to engage with investors on all aspects of the green bond program

- publishing annual allocation and impact reporting on the AOFM website no longer than 18 months after the first green bond issue.