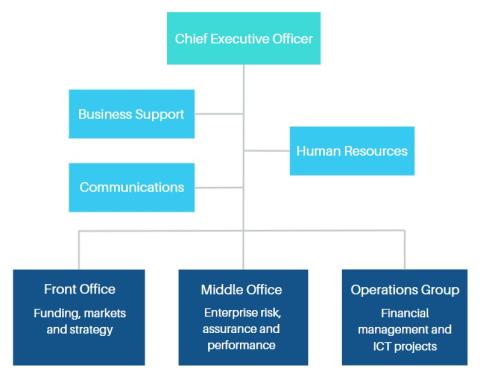

The AOFM’s organisational structure is based on financial industry best practice, including developing our teams to align with different stages of our business processes. It gives specific recognition to financial transaction‑related duties. Core operational activities form 3 broad areas.

Front Office

This comprises strategy, markets, sustainable finance and funding. Activities involve portfolio and global market research; investor engagement; and liaison with Treasury on debt policy and related financial market issues. The front office conducts tenders and syndications for the issue of AGS and manages and executes investment programs for the Australian Business Securitisation Fund and Structured Finance Support Fund. It also leads the cash management task.

Middle Office

This comprises activities to support enterprise risk management, second line risk assurance monitoring, business continuity management, security, privacy, portfolio performance measurement, data management, ICT and business systems management. Risk and compliance monitoring facilitates the AOFM’s management of risk, including adherence to the separation of back and front office functions. The middle office maintains business databases that facilitate monitoring and reporting of our business activities.

Back Office (Operations Group)

The Operations Group is responsible for accounting, budgeting, and financial management services. It manages debt financing and investment transaction settlements, ensures debt payment obligations are met in all instances, manages procurement and vendor risk and outsourced debt registry services.

Agency administrative support, executive support for the Chief Executive Officer (CEO), communications, and human resources are managed by the Office of the CEO. These functions sit outside the 3 offices described above.