Introduction

Over the past decade fiscal surpluses and proceeds from asset sales have eliminated the need for the Commonwealth to issue debt for budget financing purposes. As a result the volume of Commonwealth Government Securities (CGS) on issue began to fall as bond lines matured and repurchases were made of other stocks. Before long, it appeared that ongoing reductions in the volume of debt on issue could threaten the continued viability of the CGS market. In 2002‑03 the Government undertook a review of whether it was desirable to continue to reduce the level of outstanding CGS debt.

After extensive consultations with interested stakeholders, the Review concluded that an efficient Treasury Bond market should be maintained. It considered that, given the state of development of Australia’s financial markets and the lack of effective alternatives to CGS, the higher costs associated with managing interest rate risk without a Treasury Bond futures market would add slightly to interest rates in Australia. Further, the Australian financial system might become less diversified and more vulnerable to shocks during periods of instability. The Government announced in the 2003‑04 Budget that it would maintain sufficient Treasury Bonds on issue to support the Treasury Bond futures market. The Review did not see a need, in the absence of a funding requirement, for maintaining markets for other Australian Government debt and the issuance of Treasury Indexed Bonds was halted.

Since then the issuance of Treasury Bonds has continued at a steady rate of around $5 billion each year. In May 2008 the Government announced that it would increase issuance to $10.3 billion in 2008‑09 to support the effective operation of the market.

There have been significant changes in the Australian financial markets over the last five years. This article reviews the role of the Treasury Bond market in light of experience and developments over this period.

Changes in bond market structure and turnover

Since 2003, the volume of fixed coupon Treasury Bonds on issue has remained relatively steady at around $50 billion,[1] with the selection of bond lines and the timing of issuance targeted to support the Treasury Bond futures market. However other financial markets, and the Australian economy, grew rapidly. Over the five years to end‑June 2008, turnover in Australian financial markets more than doubled, while nominal GDP increased by over a third.

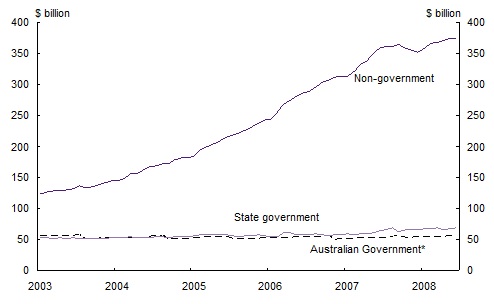

Over the five years to end‑June 2008, the total volume of bonds on issue in Australia more than doubled. Most of the increase was in non‑government bonds (see Chart 1).

- Treasury Bonds declined as a percentage of all bonds on issue in Australia from around 24 per cent at end‑June 2003 to approximately 11 per cent at end‑June 2008.

- Nevertheless the Australian Government remains the largest single bond issuer in Australia.

Chart 1: Bonds on issue in Australia

* Includes fixed coupon Treasury Bonds and Treasury Indexed Bonds (excludes Commonwealth holdings). Source: Reserve Bank of Australia

The volume of semi‑government bonds on issue in Australia has been broadly similar to that of Australian Government bonds over recent years. Some State governments have diversified their funding sources by issuing securities denominated in Australian dollars in overseas markets. The liquidity of the domestic issuance by these States was lower than if all their issuance had occurred in Australia. Over the next few years the volume of semi‑government bonds on issue is projected to increase substantially due to increased funding needs of State and Territory governments. This will enhance liquidity. In addition, these governments are likely to undertake a larger proportion of their bond issuance onshore following the Australian Government’s decision to exempt domestically issued semi‑government bonds from interest withholding tax.[2]

Over the five years to end‑June 2008, the volume of non‑government bonds on issue in Australia increased by 186 per cent. Within this total, bonds issued by banks and other financial corporations increased by 253 per cent and bonds issued by non‑residents increased by 456 per cent. This growth in issuance has been supported by sustained strong growth in funds under management, particularly superannuation funds.

New issuance of bonds in Australia by non‑financial corporations largely came to a stop in 2007‑08 when the market was disrupted by credit concerns, and the volume of bonds on issue fell over the course of the year. Corporations turned to banks for a larger share of their financing and, to meet these and other funding needs, banks increased their domestic issuance of bonds during the year. The banks also undertook extensive issuance overseas in foreign currencies.

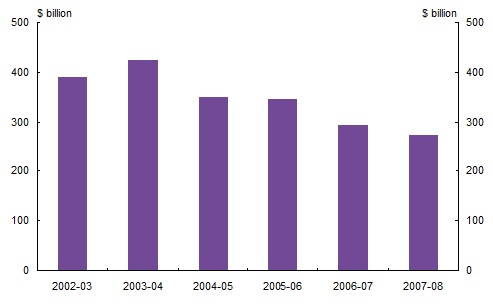

The contraction in the size of the Treasury Bond market relative to total bonds on issue in Australia has been accompanied by a downward trend in turnover. Secondary market turnover of Treasury Bonds is estimated to have fallen from $389 billion in 2002‑03 to $273 billion in 2007‑08, a decline of around 30 per cent (see Chart 2). Over the same period, turnover in semi‑government bonds rose by 22 per cent and turnover in bank and corporate fixed debt securities increased by more than 150 per cent.

Chart 2: Annual turnover of fixed coupon Treasury Bonds

Source: Australian Financial Markets Association

An important factor in the reduced turnover of Treasury Bonds has been an increased preference by investors and bond traders to use derivatives (such as futures and swaps) to adjust their portfolio and trading positions rather than trades involving physical securities. This reflects the relative ease of using derivatives and their low cost in terms of capital use.

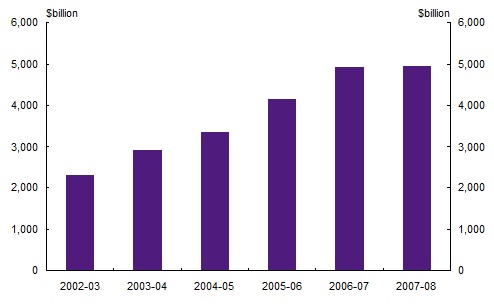

On the other hand, the annual turnover of Treasury Bond futures contracts more than doubled between 2002‑03 and 2006‑07. As a result, the annual value of Treasury Bond futures turnover is now in excess of 100 times the value of Treasury Bonds on issue. In contrast the annual secondary market turnover of Treasury Bonds is now less than 6 times the value of the bonds on issue.

Chart 3: Annual value of Treasury Bond futures turnover

Source: Australian Securities Exchange

An increase in the proportion of Treasury Bonds held by passive investors (who are more inclined to ‘buy and hold’ bonds rather than actively trade them) may also have contributed to the decline in their secondary market turnover. In particular, the proportion of Treasury Bonds held overseas has increased, including by central banks and institutional investors. However, many of these holders are prepared to use their bonds in repurchase (repo) transactions. CGS repo turnover increased slightly over the five years to 2007‑08.

Overall, it appears that financial market participants adjusted without undue difficulty to the decline in the relative size of the Treasury Bond market for much of this period. Adjustments occurred in various ways. Some domestic investors reduced their holdings of Treasury Bonds by switching to other assets. Traders made greater use of derivatives (including Treasury Bond futures contracts) in adjusting their positions and managing interest rate risk. The market generally became more efficient in its use of the available stock of bonds.

Policy actions also helped. The Reserve Bank of Australia (RBA) widened the range of securities that it would accept in its open market operations; this increased the relative attractiveness of other securities and reduced dependence on Treasury Bonds. The Sydney Futures Exchange introduced limits on net open interest positions around the close‑out of the Treasury Bond futures contracts; this reduced the risks of problems arising in close‑outs. The AOFM established its securities lending facility to lend Treasury Bonds that were in temporary short supply; this increased the confidence of market makers in dealing in the bonds.

In 2006‑07 and 2007‑08, the demand for the bonds from overseas investors increased strongly, underpinned by the strength of the Australian economy and the exchange rate. Initially the increase was able to be accommodated through reductions in holdings by domestic investors. However there was a limit on how far this could go. Strains appeared during 2007‑08 when demand for the bonds soared as turbulence in global financial markets, triggered by the sub‑prime housing crisis in the United States, encouraged a flight to quality. Some bond lines became difficult to source, bid‑ask spreads widened, liquidity deteriorated and market makers were not always able to provide two‑way prices.

The Government’s decision to increase issuance in 2008‑09 will help ease these pressures. In addition, increased issuance of semi‑government bonds by State and Territory governments, and the consolidation of some semi‑government markets following the extension of interest withholding tax exemptions, should help make semi‑government bonds relatively more attractive as close alternatives to CGS.

Pricing and referencing other financial products

For many years Treasury Bonds and Treasury Bond futures have provided the principal benchmarks for pricing other fixed‑rate debt securities and served as standard reference points when comparing rates between other financial products. This reflects the unambiguous risk‑free status of the bonds. Efficient pricing of debt securities is important not just for the functioning of financial markets, but also for the real economy and the efficient allocation of capital between sectors and alternative uses.

Other financial instruments can also act as pricing and reference points. Domestic interest rate swaps are used as a reference point for pricing some corporate securities and Kangaroo bonds. Semi‑government bonds potentially provide another reference point, but so far have not developed this role, perhaps because their market is segmented and they are not regarded as sovereign risk‑free assets, particularly by overseas investors.

The Treasury Bond spot and futures markets and the domestic interest rate swaps market have continued to provide important pricing and reference points for debt markets over the last five years. However the turbulence in financial markets in 2007‑08 affected them differently. Trading in Treasury Bonds was constrained by a heightened demand for the bonds in the face of a fixed supply, but the market continued to operate satisfactorily. The Treasury Bond futures market appeared to be little affected by market turbulence, although turnover eased along with activity in financial markets generally. Interest rate swaps were affected by the pressures on the banking system and the revaluation of credit. Bond‑swap spreads widened and, along with other credit spreads, exhibited considerable volatility.

The availability of prices for Treasury Bonds and Treasury Bond futures during this period provided pricing information that gave market participants a fuller picture of market pressures and developments than they otherwise would have had. Without information from these two sources, the pricing of other securities would have been more difficult.

Managing interest rate risk

As noted above, the 2002‑03 Review attached considerable importance to the role of the Treasury Bond futures market in managing interest rate risk (that is, the risks associated with adverse movements in interest rates). It observed that the capacity to manage interest rate risk contributes to a lower cost of capital in Australia, as investors may accept a lower yield on a corporate bond if they can hedge its interest rate risk, while the ability of financial institutions to manage interest rate risks associated with their balance sheets may contribute to lower costs for consumers on a range of products including retail loans.

Financial market participants in Australia use two main markets to manage their interest rate risk, the Treasury Bond futures market and the interest rate swap market. At the time of the Review, the Treasury Bond futures market was the primary vehicle for managing outright interest rate risk, providing standardised, exchange-traded products with high liquidity, low transaction costs and accessibility for a wide range of participants. Interest rate swaps are over-the-counter bilateral agreements tailored to meet the needs of counterparties. They are generally more expensive hedging instruments than Treasury Bond futures due to their lower liquidity, less transparent pricing and the concentrated nature of the swap market.

The Review considered that without a Treasury Bond futures market, interest rate swaps would likely become the main interest rate risk management tool. It also considered that the costs associated with interest rate swaps could increase if the Treasury Bond market were to close, as participants in the swap market use Treasury Bond futures extensively to hedge interest rate exposures associated with providing swaps. Without Treasury Bond futures, swap market participants would likely require higher premiums as compensation for taking significant additional risk on their balance sheets.

Both the Treasury Bond futures market and the interest rate swaps market have grown substantially over the past five years and each is playing an effective role in the management of interest rate risks. However, for the most part the points made by the Review continue to apply.

Events over the last year have highlighted the value of having a liquid risk‑free asset as the base for the risk transfer mechanism. Other interest rate instruments, such as interest rate swaps and semi‑government bonds, were more adversely affected by the recent financial turmoil as uncertainties developed and credit spreads widened. It is likely that it would have been more difficult and costly for financial market participants to have responded to market turbulence in managing their interest rate risks if the Treasury Bond and Treasury Bond futures markets had not been available.

On the other hand, the efficient functioning of the Treasury Bond futures market depends on the continued health of the underlying physical market. A sustained loss of liquidity of the Treasury Bond market could potentially impact on the ability of the futures market to source its settlement prices. This did not occur in 2007‑08, when all close‑outs were completed smoothly, but warrants continued vigilance.

Vulnerability of the financial system

The 2002‑03 Review considered that, without a Treasury Bond futures market, Australian financial markets may become less diversified and more vulnerable to shocks during periods of instability. It observed that, in the absence of Treasury Bonds, the interest rate swap market would likely substitute for them in a number of ways. However, this may increase the concentration of financial market activity in the banking sector, as banks play a significant role in the swap market. In times of major economic and financial instability, this could add to the risk in the financial system. Although major shocks are rare, their consequences can be more severe in less diversified systems.

In 2007‑08 the Australian financial system was significantly impacted by turbulence in global credit markets. This was sparked by problems in sub‑prime lending for housing in the United States, which brought a greatly increased caution about credit exposures and a general upward repricing of risk. There was mounting uncertainty about risks involved in structured investment instruments such as asset‑backed securities and the extent to which counterparties may have had direct or indirect exposures to losses on such instruments.

The Australian financial system appears to have been relatively free of the unsound lending and incautious investment practices. The domestic loan portfolios of the banks were of high quality, with a ratio of non‑performing assets that was low by both international and historical standards. The banks had only limited direct exposure to the sub‑prime problems in the United States, primarily through small holdings of financial instruments backed by sub‑prime debt. Some had indirect exposures through their links to institutions and businesses that were directly affected by the tightening in credit conditions.

Australian banks continued to tap both the domestic and international markets, but their funding costs increased substantially, particularly for term funding. The spread between the yield on domestic three‑month bank bills and the overnight indexed swap rate rose to over 70 basis points, compared to an average spread of around 10 basis points over previous years. Some banks issued five‑year domestic bonds at spreads of 100 or more basis points above the (increased) bank bill rate, compared to less than 20 basis points in 2006‑07.

Australian non‑financial corporations also faced increased difficulty in borrowing, both domestically and overseas. Domestic bond issuance by these corporations slowed sharply and the volume of bonds on issue fell over the course of 2007‑08. The corporations increasingly turned to the banking sector to meet their financing needs, which it was able to provide, but with a significant increase in cost.

The offshore market for asset‑backed commercial paper was particularly affected by the turmoil and largely closed to new issues by Australian entities. The domestic market remained open and onshore issuance increased, covering some of the shortfall, but at significantly higher spreads than in the past. Some of the funding vehicles that relied on asset‑backed paper were able to draw on liquidity facilities provided by the banks or alternatively sold their paper to the banks that sponsored them.

The market for residential mortgage‑backed securities (RMBS) experienced even greater difficulties as the sources of funding for these securities were reduced. While the credit quality of Australian RMBS remained high, these securities were adversely affected by the general repricing of risk originating from overseas markets and reduced demand as investors, particularly from overseas, consolidated their investment activities. In the first half of 2007 domestic RMBS of the highest credit quality were trading at spreads of less than 20 basis points above the bank bill swap rate, but these spreads rose as high as 150 basis points in 2007‑08. It became unprofitable for housing lenders to issue RMBS at such spreads, even with some increases in mortgage interest rates, and the stock of RMBS on issue fell by over 18 per cent in the year.

- One outcome of these various pressures was substantial re‑intermediation in the financial system as banks were forced to provide a larger share of the financing for the corporate sector. The banks were able to meet this need as their balance sheets were strong and they were able to increase their borrowings domestically and abroad, albeit at substantially increased cost. In particular, bonds issued by Australian banks increased by almost 20 per cent in 2007‑08. The liquidity of the financial system was also supported by actions of the RBA, which widened the range of acceptable securities in its open market operations.

The interest rate swap market continued to operate, but was adversely affected by the pressures on the banking system and credit market turmoil. Its liquidity was reduced, with bid‑ask spreads widening and considerable volatility in bond‑swap spreads.

If there had been no Treasury Bond futures market, the demands placed on the swap market for the hedging and management of interest rate risk would have been greater. Given the general soundness of the Australian banking system, it may well have been able to carry the additional burden without difficulty. Nevertheless, this experience highlights the advantages of maintaining diversity in the structure of the financial system, so that the impact of major financial shocks, when they arise from time to time — as they inevitably must — can be better absorbed and distributed.

The shocks flowing from the recent global credit crisis have been severe, even extreme, in historical experience. Australia has been fortunate that they came at a time when its economy was prosperous, buttressed by the long‑term growth of the Chinese economy, high commodity prices, and a strong exchange rate. Despite this, the impact was deep and extensive. Maintaining the strength of the financial system can help reduce its vulnerability in the future.

Some other arguments advanced for continued issuance

The 2002‑03 Review also considered, but did not accept, some other arguments for continuing to issue Treasury Bonds in the absence of fiscal deficits. Subsequent experience appears generally to have supported its conclusions in this regard.

Providing instruments for investment

Many investors view Treasury Bonds as attractive long‑term investments because of their low credit risk. In announcing its decision in 2003 to maintain the Treasury Bond market, the Government noted that this would maintain the ability of such investors, including superannuation funds, to hold Commonwealth Government bonds, but emphasised that its decision was not specifically targeted at meeting investor demand for risk‑free assets. Various alternative low risk investment options were also available, including State government debt and debt issued by highly rated supranational institutions.

Since then, the supply of Treasury Bonds on issue has remained fixed while the volume of funds under management in Australia has grown dramatically. Investors appear to have adjusted readily to this shift in relativities. In part, this may have been because, an increased range and volume of other low risk long‑term assets became available.

- State and Territory governments maintained their issuance of long‑dated bonds and some have issued bonds with longer maturities than the Commonwealth. The volume of semi-government issuance is likely to increase in the future.

- Kangaroo bond issuance has grown rapidly.[3] The volume of Kangaroo bonds on issue increased from around $20 billion in 2003 to more than $100 billion in 2007-08. Around 50 per cent of these bonds are AAA‑rated. While the bulk of Kangaroo bond issuance has been for medium‑term maturities some issuance has been long‑term.

- Some very long‑dated domestic infrastructure bonds have also been issued.

Another factor that may have facilitated the adjustment to a smaller relative supply of Treasury Bonds was a shift in investor preferences away from lower risk investments in order to achieve higher returns. However, this trend was reversed in 2007-08 when developments in global financial markets brought a greater aversion to risk and a flight to higher credit quality. Part of this increased aversion to risk may prove temporary, but to the extent that it persists it could bring an on-going increase in the demand for low risk securities in the future.

Nevertheless, with the increased availability of alternative low risk investment instruments, there does not appear to be a strong public policy case in Australia for issuing Treasury Bonds to meet demands for them by particular categories of investors.

Implementing monetary policy

Prior to 1997 the RBA conducted its domestic market operations using only CGS. Since then, in response to the declining supply of CGS, it has progressively widened the range of acceptable collateral it uses in its domestic open market operations. At times in recent years it has also used foreign exchange swaps in its conduct of monetary policy.

The bulk of the RBA’s domestic open market operations are now conducted by way of repurchase agreements involving bank bills, bank certificates of deposit and semi‑government securities. Transactions involving CGS are now only a small proportion of its activities. This has not noticeably constrained the operation of monetary policy.

Attracting foreign capital inflow

The share of Treasury Bonds on issue held by non‑resident investors has increased over recent years and at end‑June 2008 was more than 60 per cent. This increase has been supported by interest rate differentials and a strong Australian dollar, but may also have been affected by overseas investors diversifying their foreign currency exposures.

Chart 4: Non‑resident holdings of Treasury Bonds

The benefits of foreign capital inflows depend on the use to which the inflows are put. In the absence of a borrowing need, there is no strong case for issuing government debt to attract such inflows. With a strong economy and a floating exchange rate, attracting capital inflows does not provide additional grounds for issuing Treasury Bonds.

Promoting Australia as a global financial centre

Australia’s financial markets and associated market infrastructure are sophisticated and well regulated giving them a leading position in the Asia‑Pacific region. In particular, Australia is a regional leader in the issuance of international and domestic securities and has more international debt securities outstanding than any other Asia‑Pacific nation. An efficient Treasury Bond market is a core element in the operation of the Australian financial system. However the 2002‑03 Review did not nominate the promotion of Australia as a global financial centre as grounds for maintaining the Treasury Bond market.

Australia’s financial markets and the financial services sector have grown vigorously over recent years and maintained Australia’s position as a global financial centre. It is likely that liquid Treasury Bond and futures markets have played some part in this growth, particularly given the active offshore participation in those markets. Even if this role does not in itself justify retention of the Treasury Bond market, it is an added benefit of doing so.

The cost of Treasury Bond issuance

The benefits of maintaining the Treasury Bond market must be weighed against the debt servicing costs of the bonds issued, less the returns obtained from the use of the proceeds.

Since 2003 the proceeds of bond issuance not required for the redemption of maturing debt have been placed in term deposits with the RBA. The weighted average yield obtained on these deposits over the five years to end‑June 2008 was 5.88 per cent, while the weighted average yield on Treasury Bonds issued over this period was 5.61 per cent. By this test, the additional issuance to maintain the Treasury Bond market did not impose a net cost on the Commonwealth.[4]

In his announcement of increased Treasury Bond issuance on 20 May 2008, the Treasurer indicated that the AOFM would manage the investment of the proceeds of the additional issuance using a wider range of investment instruments. Since July 2008 the AOFM has invested these proceeds in a range of low risk securities, including bonds issued by State governments and Kangaroo bonds issued by supranational organisations. These assets yield a positive spread over Treasury Bonds. As a result, the increase in issuance is likely not to involve any net cost to the Government.

Conclusion

There have been significant changes in Australian debt markets over recent years, but the Treasury Bond and Treasury Bond futures markets remain important to the Australian economy for the roles they play in the management of interest rate risks and in strengthening the resilience of the financial system to major shocks. In particular, the recent financial market turbulence has highlighted the roles of the Treasury Bond and Treasury Bond futures markets as anchors for the financial system.

In order to maintain liquid and viable Treasury Bond and Treasury Bond futures markets the volume of Treasury Bonds on issue will need to be adjusted from time to time to allow for growth in demand as a result of growth in financial market activity. The Government’s decision to provide legislative authority for future increases in issuance provides an appropriate framework for such adjustments. The AOFM will continue to monitor developments in the market and advise on appropriate policy responses.

Footnotes

[1] Following the decision in May 2008 to increase issuance of Treasury Bonds, the volume of fixed coupon Treasury Bonds on issue is expected to total approximately $55 billion at end‑June 2009.

[2] Previously the securities issued overseas benefited from exemption from interest withholding tax, but those issued in Australia did not.

[3] Kangaroo bonds are Australian dollar denominated bonds issued by non-residents.

[4] Some funds were transferred to the Future Fund and the Higher Education Endowment Fund where they were expected to obtain a higher yield for the Commonwealth. For example, the Future Fund has a long‑term target return of 4.5 to 5.5 per cent real. However the net benefits or costs obtained from these transfers should be counted separately from those of the decision to maintain the Treasury Bond market.