Introduction

During 2003‑04 the AOFM completed the unwinding of its foreign currency derivatives. This brought to a close a long period in which the Australian Government had a significant foreign currency component in its debt portfolio. Until 1988 this foreign currency debt was all in the form of loans, but from the early 1990s domestic borrowing swapped into foreign currency became the dominant component. The following is a review of the experience of foreign currency exposure in the Australian Government’s debt management operations.

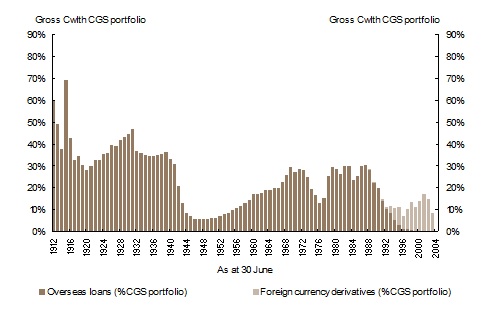

Chart 1: Foreign currency share of CGS debt

Chart 1 shows foreign currency debt as a share of Commonwealth Government securities (CGS).[1] For 30 years following the first raising of Commonwealth Government securities in 1912, foreign currency debt consistently represented a major part of the portfolio, averaging a little under 40 per cent. This included the period of large scale borrowing during the First World War. By contrast, the foreign currency share fell sharply during the Second World War, when large scale borrowing for war finance was primarily focused on domestic markets. The share gradually rose again in the post-war period to 30 per cent in 1969 and, apart from brief decline during the first half of the 1970s, stayed around this level until 1988. Thereafter, the foreign currency loan portfolio was wound down, while foreign currency swaps expanded. Over the last 15 years the foreign currency share averaged around 12 per cent of the Commonwealth Government securities portfolio — less than half the share in the previous period.

A range of historical and policy factors have influenced these trends.

Foreign currency loans

For the first 10 years following Federation, the Commonwealth did not have any public debt as budget revenues exceeded outlays. The first Commonwealth debt was taken over from South Australia on 1 January 1911 as a consequence of the transfer to the Commonwealth of the Northern Territory and the Port Augusta to Oodnadatta railway. Around 60 per cent of this debt was payable in London.[2] The Commonwealth Inscribed Stock Act 1911 provided for the issuance of debt by the Commonwealth. The legislation was first used for internal transactions within the Commonwealth’s own accounts. The first public bond issue in Australia was made in 1915 as part of financing the war effort.

Borrowing in London played an important role in meeting the heavy debt financing requirements of the First World War. The government both borrowed directly on its own behalf from the United Kingdom government and raised public loans in London.[3] Around one‑third of the thirty‑fold increase in Commonwealth public debt during the war was met through foreign loans in London.

During the 1920s, the Australian Government returned to the London market annually and its Sterling debt increased significantly during this decade. The States were also independently accessing the London market at this time. By the mid‑1920s there were concerns that the terms available might be adversely affected by the large volume of borrowing being undertaken in London by Australian and the other dominion governments. As a result, the Government approached the New York market for the first time in 1925.

The Australian Loan Council was established, initially on a voluntary and informal basis in 1923 and then on a permanent basis in 1927, to coordinate the loan raisings of all Australian governments. One of the principles followed by the Loan Council was that the Australian Government should restrict its borrowings to overseas loans, reflecting its comparative advantage in these markets. By June 1931, foreign currency debt had grown to around 47 per cent of the Commonwealth’s own Commonwealth Government securities portfolio.

The resort to overseas markets was motivated in part by their depth and liquidity relative to domestic markets. However, prior to the return of Sterling to the gold standard in 1925, disruptions to foreign exchange markets compelled Australian governments to borrow in Australia ‘beyond the amount which could be properly raised here’[4] — at interest rates 1.25 per cent higher than in London.

The Depression caused a crisis in government finances and led to the adoption of a series of measures in what became known as the Premiers’ Plan. This included the conversion of all the domestic debt of Australian governments based on a 22.5 per cent reduction in the interest on that debt. The British Government also agreed to suspend principal and interest payments on the Australian Government’s own war debt.[5] A Minister without Portfolio was appointed to go to London to manage the conversion of maturing London loans and those loans on which the government had early redemption options. The conversions were successfully negotiated over a period of years and the yield on new loans reduced over time.

The next 20 years saw a reduction in overseas borrowing by the Commonwealth and the States. The Government’s activity in overseas markets during the 1930s was largely restricted to conversion operations on maturing loans or exercising early redemption options.[6] The unprecedented financing requirements of the Second World War were met largely through domestic borrowing.

The Australian Government returned to overseas markets in the 1950s and maintained an active borrowing program until the late 1980s. Overseas borrowings were undertaken primarily to support the balance of payments in a period when national development required large imports of capital, and to help pay for the overseas component of budget spending (the ‘overseas deficit’).

The major source of foreign borrowing by the Australian Government during the 1950s was the International Bank for Reconstruction and Development (the World Bank), particularly during the first half of the decade. These loans were in US dollars. In the second half of the decade the Government returned to the New York bond market (1956) and tapped commercial loans in the United States as well. During the 1950s, US dollar loans took over from Sterling loans as the major component of overseas borrowing. The Government also approached for the first time the capital markets in Switzerland (1953) and Canada (1955).

The 1960s and 1970s saw the Australian Government access the Netherlands (1961), West German (1967) and Japanese (1973) markets for the first time. It returned to these and the New York, Eurodollar and Sterling markets regularly during this period. The diversification of funding sources was undertaken to reduce borrowing costs as well as to spread risk.

Foreign currency debt gradually increased as a proportion of Commonwealth Government securities during the 1950s and 1960s. A significant part of this increase occurred in the late 1960s to fund the overseas deficit arising from defence purchases around the time of the Vietnam War.

Between June 1972 and June 1976 the foreign currency share of Commonwealth Government securities fell to around 13 per cent as domestic borrowing grew sharply to fund budget deficits. The share had returned to around the 30 per cent level by the late 1970s and remained there until the late 1980s, when an improved fiscal position provided scope to repay debt.

The last borrowing in overseas markets took place in 1987. The Government then decided to concentrate its debt in the domestic Commonwealth Government securities market in order to maintain the liquidity and efficiency of that market, and to repay its foreign currency loans. Over the next four years it exercised early call options and undertook market repurchases of foreign loans wherever practicable. The foreign currency share of Commonwealth Government securities fell to around 14 per cent by June 1991.

Outstanding overseas loans gradually declined further over time with maturities, so that at 30 June 2004 they represented only 0.2 per cent of the gross Commonwealth Government securities portfolio. This small foreign currency exposure consists of US Yankee loans ($US17.9 million) and Sterling Bulldog loans (£39.1 million) originally issued in the 1980s. There have been repurchases of these loans in past years and the outstanding amounts are the last remaining residuals of the original loans. The AOFM will continue to seek to repurchase this stock.

Foreign currency swaps

For many years following the first issue of Commonwealth debt, borrowing decisions were based on assessments of market conditions, including the availability of funds and the likely cost of borrowing, in various markets, along with the funding expected to be required each year for budget and balance of payments purposes. The overall cost and risk of the Commonwealth Government securities portfolio were managed without access to formal analytical techniques.

The breakdown of the Bretton Woods system of fixed exchange rates in 1971 and the floating of the Australian dollar in 1983 brought greater volatility in exchange rates and greater awareness of currency risk. This awareness was further heightened in the mid‑1980s by movements in exchange rates between the Australian dollar and the other currencies in the Commonwealth Government securities portfolio: in June 1987 the foreign currency component of the portfolio included US dollars (32 per cent), Japanese yen (27 per cent), Deutsche marks (15 per cent), Swiss francs (11 per cent), Netherlands guilders (9 per cent) and Sterling (6 per cent).

Commencing in 1987, the Treasury undertook, with the assistance of external financial consultants, a review of the optimal currency and interest rate structure for the Commonwealth Government securities portfolio.[7] By that time, the use of portfolio management analysis to consider the cost and risk of financial portfolios had become well established for asset managers, but its use for liability management was relatively new.

During the 1970s and 1980s, financial deregulation and innovation in global financial markets saw the evolution of liquid and efficient swap markets. The development of swap markets provided a cost-effective tool by which funding and risk exposure decisions in debt management could be managed separately. While in principle it would have been possible to adjust the composition of a debt portfolio to a desired benchmark solely through the issuance and repurchase of bonds, in practice this could be slow and expensive. The availability of swaps allowed changes in portfolio composition to be achieved quickly and inexpensively.

The initial analysis of the Commonwealth’s debt portfolio was in the form of short-term portfolio optimisation performed at six-monthly intervals and focused on the relative cost and risks of debt in different currencies and for different terms. It concluded that the foreign currency exposure then held by the Commonwealth should be concentrated in US and Canadian dollars, and with a larger component of floating rate debt. As a result, swaps were executed out of Netherlands guilders into Deutsche marks, and from Deutsche marks/Sterling/Japanese yen into US and Canadian dollars.

In the early 1990s, the portfolio analysis developed a long-term perspective on the cost/risk trade‑offs. It supported maintaining a continuing US dollar exposure in the portfolio and a benchmark target was established as a long-term policy that aimed to strike a balance between the cost and volatility of the overall portfolio. It was recognised that fluctuations would occur from year to year with exchange rate and interest movements, but with net benefits expected to accrue over the long term.

By around 1991-92, due to maturities and repurchases, outstanding foreign currency loans had declined to a level below that of the benchmark target. In view of the expected long-term cost benefits of maintaining a continuing US dollar debt component, as indicated by the analysis, it was decided to maintain the benchmark and to do so by swapping domestic Australian dollar debt into foreign currency exposure. This could be done through swaps at lower cost than by issuing new foreign currency loans.

Through the remainder of the 1990s, the Australian Government undertook cross‑currency swaps, primarily from Australian dollars to US dollars, to maintain foreign currency exposure at the benchmark target. The benchmark foreign currency share target was reviewed, with the assistance of external consultants, in 1995 and 1998. These reviews reaffirmed the target.

In the first half of the 1990s the volume of cross‑currency swaps increased as a result of the growing Commonwealth Government securities debt portfolio and ongoing maturities of foreign currency loans. However, in the second half of the decade, sustained fiscal surpluses significantly reduced the size of the Commonwealth Government securities portfolio, reducing the need for new cross‑currency swaps to meet the benchmark target. The last cross‑currency swap to add new foreign currency exposure to the portfolio was executed in February 1999.

As the total portfolio contracted, it became necessary to reduce the outstanding cross-currency swaps in line with the benchmark. This was reinforced by the depreciation in the exchange rate following the 1997 Asian crisis, which increased the size of the existing foreign currency exposure measured in Australian dollars and therefore its share of the portfolio. The Australian dollar came under severe pressure in 1999-2000 and 2000-01, falling to a historic low below 0.48 US cents in April 2001.

In this context, concerns developed that the transactions required to terminate cross-currency swaps may have added to pressures on the exchange rate. In October 2000, at the request of the Governor of the Reserve Bank of Australia, the Secretary to the Treasury suspended the foreign currency target. This action was confirmed by the Treasurer.

A review of the policy was undertaken by the newly established AOFM. The review re-assessed the trade-off between the cost and cost volatility of foreign currency exposure, taking account of the recent experience of very volatile exchange rate movements, year-to-year cost outcomes and the risks of exacerbating exchange rate pressures. It concluded that any longer term cost advantage associated with foreign currency exposure had been significantly reduced and no longer provided sufficiently attractive cost reductions to offset the increased short-term cost volatility of this exposure. It recommended that the policy of maintaining a foreign currency exposure be terminated and the existing exposure eliminated. The Treasurer agreed to these recommendations in September 2001.

An orderly unwind was conducted by reference to a rundown schedule that specified the US dollar amounts to be unwound at various exchange rates. The structure of the rundown schedule and its operational aspects were agreed between the AOFM, the Treasury and the Reserve Bank of Australia with a view to maintaining orderly conditions in foreign exchange markets.

The unwind was implemented through a combination of cross‑currency swap maturities and early terminations. Where these cross‑currency swap redemptions did not coincide with the rundown schedule, the timing was adjusted using forward foreign exchange contracts with the Reserve Bank of Australia. By the end of December 2003 the net currency exposure on foreign currency derivatives had been eliminated. The last remaining cross‑currency swap was terminated along with its associated foreign currency forward contract hedge in February 2004.

The unwind of the foreign currency derivative exposure occurred over a period when the Australian dollar appreciated strongly from around 0.49 cents at the end of September 2001 to over 0.73 cents in late December 2003. Overall, in the 28 months between September 2001 and December 2003, the AOFM unwound $US6,372.1 million of US dollar exposure at a weighted average exchange rate of 0.6470 US dollars.

Economic outcome of the foreign currency swaps

Over the lifetime of the policy between 1988 and 2004, the foreign currency swaps, and forward exchange contracts used in the unwinding, generated a total economic benefit to the Commonwealth of $783.7 million in realised cash flows. This represented an average saving in debt servicing costs of $49.4 million per annum, or around 7 basis points per annum on the average volume of Commonwealth Government securities debt on issue for the Commonwealth.

Two factors drove this economic return, namely interest rate differentials and exchange rates. Broadly, cross‑currency swaps captured the benefit of typically lower US interest rates (relative to Australian interest rates) in their net swap interest flows, but were exposed to variations in the exchange rate that could lead to gains or losses on the final exchange of swap principal. Over the entire lifetime of the policy, the foreign currency derivative portfolio generated:

- net interest savings of $1,958.1 million, arising from direct swap interest flows whereby the Commonwealth paid lower US interest rates and received higher Australian interest rates, and the interest savings from the reinvestment of net positive swap cash flows over the life of the policy; and

- net losses on exchanges of principal when the swaps were adjusted, terminated or matured of $1,174.4 million.

It was always to be expected that the gains and losses on interest and exchange rate movements would be in opposite directions and partially offsetting, since economic theory suggests that interest rate differentials and exchange rate expectations will, to some extent, be equilibrating over time.

While the economic return referred to above represents the realised outcome over the whole period of the policy, public attention also focused on the year-to-year gains and losses from changes in exchange rates. Foreign exchange gains and losses have been reported as a profit or loss item in the Government’s financial statements since the introduction of accrual accounting to the Commonwealth’s accounts in 1998-99.[8] They include unrealised gains and losses on the outstanding value of the portfolio. Large foreign currency losses were reported for 1997-98, 1999-2000 and 2000-01. However, these losses were smaller, relative to the size of the Commonwealth Government securities debt portfolio, and relative to GDP, than had occurred on several occasions in previous years when the foreign currency exposure was entirely in the form of loans.

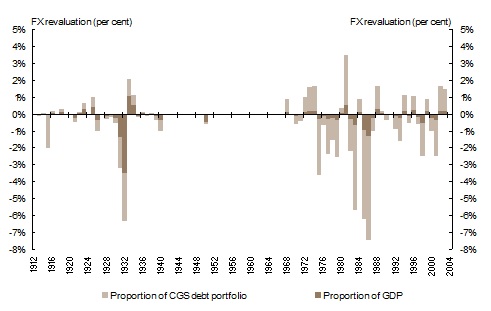

Chart 2 shows annual changes in the value of the Commonwealth Government securities debt portfolio due to exchange rate movements since 1912, on both foreign currency loans and foreign currency derivatives. The chart is based on revaluing the foreign currency exposure in the portfolio using the prior year’s end of year exchange rate.[9] The results are expressed as percentages of the portfolio and GDP.

Chart 2: Foreign currency revaluations in the CGS debt portfolio

The chart illustrates that significant foreign currency revaluation effects have occurred not only since the breakdown of the Bretton Woods system of fixed exchange rates in 1971, but also on occasions in earlier periods with exchange rate realignments. Foreign currency revaluation effects amounting to more than 2 per cent of the Commonwealth Government securities portfolio occurred in 13 years — three in the financial crisis of the early 1930s, eight between 1975 and 1987 and two since the introduction of cross‑currency swaps in 1988. Relative to GDP, the revaluation effects were much larger in the early 1930s and between 1984 and 1986 than in the recent period.

Nevertheless, the changes in the value of the portfolio caused by exchange rate movements after 1998 probably attracted more public attention than the larger changes experienced in the 1980s. The greater transparency of the swap exposures, and the fact that they were no longer tied to physical issuance, may have influenced this outcome and reduced the acceptable level of volatility in the debt portfolio below what had been assumed in the modelling used to establish and validate the benchmark. There was also insufficient recognition of the potential for strongly adverse exchange rate movements to occur in periods of fiscal surplus, resulting in a doubling up in the adjustments that needed to be made to the size of the swap portfolio and volumes of transactions, raising issues for macro-economic management.

Conclusion

Over a long period the Australian Government had very substantial foreign currency debt. Initially, the resort to foreign debt reflected the small size and depth of domestic financial markets relative to those overseas. It also reflected the need to borrow foreign exchange to support the balance of payments under a system of fixed exchange rates and controls on private sector international capital flows.

In recent years, these circumstances have changed dramatically. With better macro‑economic management and more conservative fiscal policies, the Government’s borrowing requirements are smaller. Indeed, bond issuance is now driven by the desire to support the operation of financial markets rather than budget funding. Australia’s financial markets have developed enormously in depth and sophistication, as have global financial markets. International capital flows more freely, and the currencies in which it is denominated do not need to be tied to the currencies of the countries from which it originates. Derivative markets have developed that allow much greater sophistication in portfolio management.

The Australian Government no longer needs to borrow in overseas markets and is able to issue more cost effectively in domestic markets for the volumes it is likely to require. While the availability of derivatives allows the cost and risk of the debt portfolio to be managed separately from bond issuance, the advantageous trade-off between cost and risk that was seen in the 1980s and 1990s in maintaining a continuing foreign currency exposure in the Commonwealth Government securities debt portfolio is no longer present.

The portfolio management techniques first adopted by the Australian Government with the introduction of cross-currency swaps have since been developed, expanded and refined. The Commonwealth Government securities debt portfolio continues to be managed to a benchmark, although the benchmark now in place has a zero foreign currency component, and the AOFM remains committed to international best practice in portfolio management, tailored to the current objectives and circumstances of the Commonwealth.

Footnotes

[1] All figures in this section exclude debt issued by the Commonwealth on behalf of the States.

[2] This was below the average for State debt at the time. As at 30 June 1910, 74 per cent of the public debt of the States was redeemable in London.

[3] These loans were raised exclusively to provide funds for the States during the war.

[4] 1925-26 Budget Speech.

[5] This suspension was extended until it was dropped formally from Commonwealth debt statistics in 1947-48 with effect from 1931-32.

[6] One exception was a new money loan to fund defence expenditure in 1938 which was specifically outside the framework of the Loan Council, consistent with the 1927 Financial Agreement.

[7] A report on an optimal portfolio structure was initially commissioned from external consultants and received in 1987. This report also recommended the use of swaps for liability portfolio management. A consultancy contract for regular portfolio management analysis from external consultants was commenced from 1989.

[8] The Government introduced accrual accounting on the basis of Australian Accounting Standard 31 (AAS31). Government departments had been reporting on this basis in their agency financial accounts for some years prior to this reform.

[9] This is used as a broad proxy for foreign currency gains and losses over the period the Commonwealth has had foreign currency exposure. It does not have the accuracy of the AAS31 measure which takes account of new foreign currency exposure acquired or redeemed during the year at exchange rates different to the prevailing rates at the start or close of the financial year.